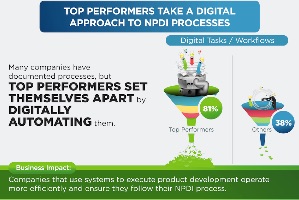

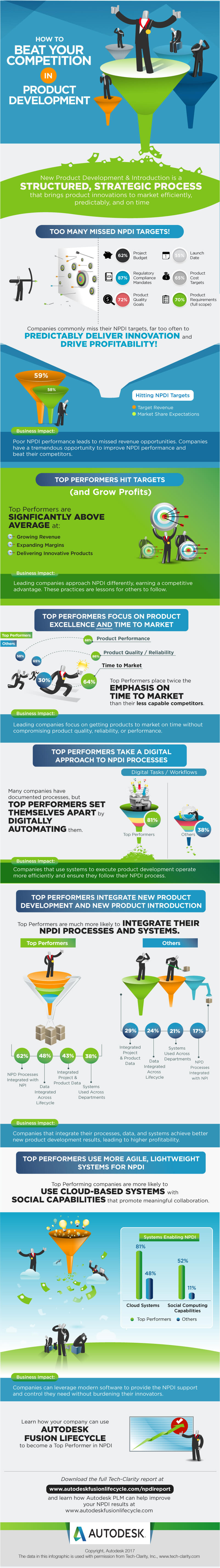

This infographic shares our research on how Top Performing companies achieve better NPDI performance than their competitors, excelling at revenue growth, margin expansion, and delivering innovative products. The infographic starts by providing a graphical view of the unfortunate truth about new product development, companies miss their quality, cost, requirements, regulatory compliance, project budget, and time to market targets far too often. The graphic shares perspectives from our research.

The piece is an Autodesk infographic leveraging data from our 7 Ways to Outperform Your Competitors in NPD research.