A quick peek into some research on how manufacturers can achieve the positive business benefits of software-intensive products without suffering the common, negative challenges and business impacts resulting from increased product development complexity. The report, Tech-Clarity Perspective: Developing Software-Intensive Product: Addressing the Innovation-Complexity Conundrum, highlights the results of a survey of over 100 manufacturers to help companies address this conundrum. The survey results are clear – companies are not backing away from the trend of putting more software in their products – so designers have to address the challenge or suffer poor quality, inefficiency, and other drains on profitability. In addition, the report shares the perspectives of tier 1 automotive supplier Continental and in-car location and navigation provider TomTom on how they address the complexity of developing software.

Note: See press release from PTC announcing the report here, along with a link to download the report from their site

The Research Findings

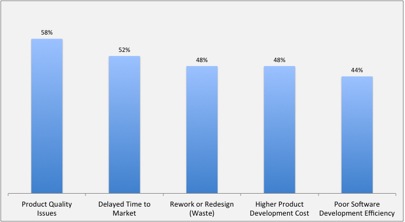

Where should I start? This is a very rich report, and definitely worth a read. Let me summarize by sharing some of the most common benefits and negative impacts companies experience when developing software-intensive products. The benefits were relatively well covered in the post and underlying paper Mechatronics: Driving Product Innovation with Embedded Software, although this report gives more detail. A quick summary of the benefits includes top-line drivers like improving product capabilities, “smarter” and more innovative products, and tailoring products to customers or markets. But software also drives complexity that leads to challenges (detailed in the report) and significant, negative business impacts quality issues, time to market delays, waste from rework, high product development costs and poor software development efficiency (see Figure). Notice that the percentages add up to well over 100%, meaning that companies are experiencing combinations of these issues that erode the profitability benefits of software-intensive products.

Where should I start? This is a very rich report, and definitely worth a read. Let me summarize by sharing some of the most common benefits and negative impacts companies experience when developing software-intensive products. The benefits were relatively well covered in the post and underlying paper Mechatronics: Driving Product Innovation with Embedded Software, although this report gives more detail. A quick summary of the benefits includes top-line drivers like improving product capabilities, “smarter” and more innovative products, and tailoring products to customers or markets. But software also drives complexity that leads to challenges (detailed in the report) and significant, negative business impacts quality issues, time to market delays, waste from rework, high product development costs and poor software development efficiency (see Figure). Notice that the percentages add up to well over 100%, meaning that companies are experiencing combinations of these issues that erode the profitability benefits of software-intensive products.

So what can be one about this? I wouldn’t be doing my job if I didn’t point out what can be done to combat the complexity and take advantage of the benefits. Analyzing the organizational, business process, and technology enablers in place at responding companies and comparing it to the negative impacts they encounter leads to some interesting conclusions. In specific, data shows that companies with the following characteristics reported fewer significant, negative impacts when engineering products that include electrical, mechanical, and software components:

- Unified or integrated teams for electrical, mechanical, software engineering

- Use of systems modeling

- Unified or integrated solutions for designing software-intensive products

- Use of formal data / lifecycle management solutions (ALM and/or PLM)

Implications for Manufacturers

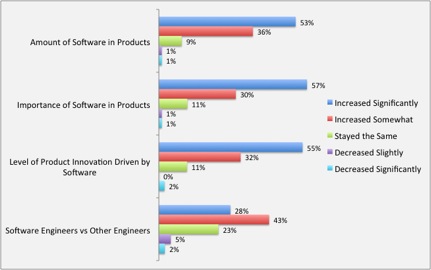

The survey results show a clear trend over the last five years and into the next five – software will continue to play a growing role in today’s (and tomorrow’s) products. The report asked four different perspectives on the trend of software in products, sometimes called “embedded software” although frequently it is not embedded on chips as the term originally implied. The survey results clearly show that, as the report states: “The majority of companies significantly increased the amount of software, the importance of software, and the innovation driven by software in their products over the last five years – and plan to increase these further over the next five years.” Responding manufacturers also increased the ratio of software engineers to other engineers and plan to continue that trend. In fact, André Radon, VP IT Competence Center Engineering Applications for Continental explains in the report that “We are actually a software company. The majority of our engineers are software engineers.”

What does all this mean? The stakes are high in terms of the benefits available and the potential negative impacts. As Tech-Clarity’s earlier report, Issue in Focus: Systems and Software Driven Innovation: Complexity and Opportunity in the Mechatronic Era, concludes, “Software driven innovation is the new frontier of competition, helping companies drive more rapid innovation and creating opportunity due to the increased flexibility and agility of software-based products.” The survey results support that conclusion, making addressing this conundrum a top priority for future competitiveness.

So that was a quick peek into some recent research on developing software-intensive products, I hope you found it interesting. Does the research reflect your experiences? Do you see it differently? Let us know what it looks like from your perspective. Please feel free to review more free research and white papers about PLM and other enterprise software for manufacturers from Tech-Clarity.