What if MES were fully natively integrated into an end-to-end suite across the product and production lifecycle? For years, industry analysts have remarked that Siemens had acquired all the pieces—if only they could put them together. We recently had a briefing that focused on the MES, Opcenter, and the progress made toward the end-to-end goal:

- Across all industrial markets (Discrete, Process, Hybrid, …)

- Everywhere in the industrial world

- Open to integrate with customers’ existing systems of record (ERP, etc.)

- Uniting: Design (Designcenter, Teamcenter, Dotmatics), Engineering (Simcenter, Tecnomatix), IT (Mendix, Rapidminer), production (Opcenter, Totally Integrated Automation Portal), IIoT (Insights Hub), Supply Chain (AX4, SupplyFrame), and Automation (Industrial Edge)

Siemens is moving toward this goal, leveraging capabilities such as their low-code application development environment (Mendix) and their Siemens Xcelerator digital business portfolio in conjunction with Opcenter. Another advantage is Siemens’s 175+ year history as a manufacturer, including 200+ factories of its own today. A manufacturing environment that Siemens Digital Industries Software can leverage as an ‘in-house laboratory’ for testing and evaluating their software solutions, including AI innovations, as well as the automation hardware assets provided by Siemens Digital Industries.

The Opcenter X Journey

New this year is Opcenter X, combining MES, quality execution, scheduling, and LIMS on a new common cloud-native Opcenter platform.

The Opcenter brand was created in 2019 as an umbrella over several acquired/developed software products under the heading of MES/MOM. Initial development started with the user interface and data hub, allowing Siemens to market product sets for specific manufacturing industries. These early options used different underlying MES systems depending on the vertical industry.

In parallel, Siemens began the long and arduous process of creating a common platform, aided by some key technologies that they had available. The Opcenter Execution platform is moving rapidly from their two heritage MES products to a single modular, scalable, cloud native infrastructure with a lower TCO than traditional MES solutions.

We recall discussing the long-range plan with Siemens in 2023, where this migration from multiple applications to a single modular infrastructure was planned to be completed in 4 years. Now we are seeing the initial deliveries on this platform in 2025. Over the next two years, Siemens intends to deliver functionality for the remaining supported industries.

Focus on TCO, Configurability, and Scale

Companies, especially small and medium-sized manufacturers, need a more cost-compelling approach to MES. The total cost of ownership is more than the cost of the software. Other considerations include the time and expense of implementation, including configuration, training, and integration. Siemens has addressed these cost challenges in several ways:

- They have developed a new cloud-based common platform that supports individual applications, allowing customers to implement only what they need.

- They provide (driven by Mendix), low-code process and UI development based on customers’ business logic and individualized needs. Traditional MES implementations often cost more than double the cost of the software. Customers who leverage these tools can manage more of the deployment of the system in-house, choosing from 28 predefined templates, persona-based, industry-specific, and process-centric, that they claim have reduced implementation time and effort by 50 to 80%.

- They are committed to open connectivity, which eases integration with customers’ existing systems of record and reduces the time and effort required to build and maintain a digital thread.

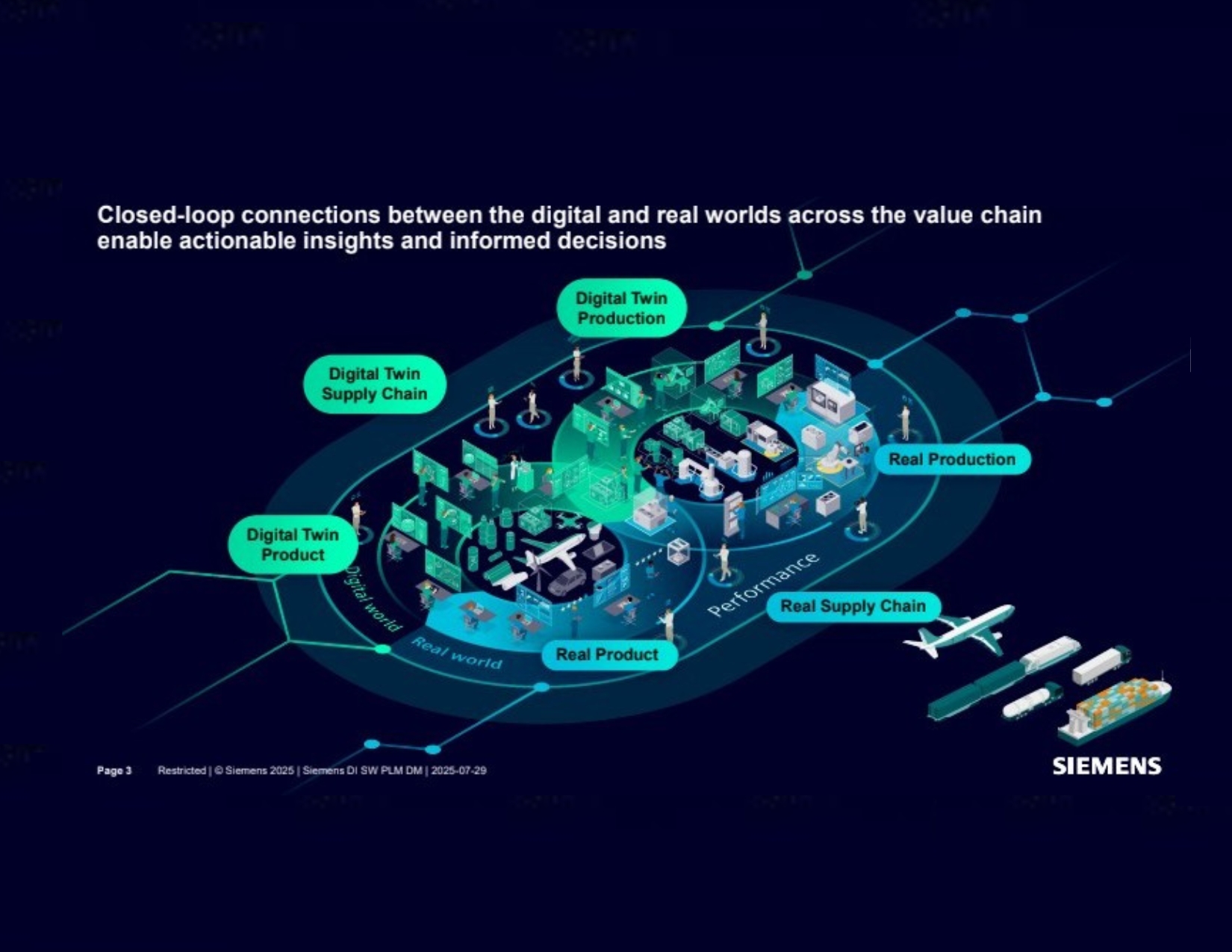

- They are building closed-loop connections between product, production, supply chain planning, and execution.

Future Direction: Digital Thread, Service Lifecycle Maintenance, and AI

Siemens announced Teamcenter Service Lifecycle Management 2-3 years ago, and it is now becoming a cornerstone of their strategy for the Aerospace and Defense (A&D) market, while also serving multiple industries. As reported by Tech-Clarity in “Siemens Support for SLM Exceeded Our Expectations”, the combination of this SLM capability as part of the Siemens Xcelerator portfolio fills in key artifacts to the digital thread, enabling full lifecycle support from product design through services.

From an Opcenter perspective, they are betting on the assumption that service plan execution contains many fundamental similarities to production order execution. They are incorporating capabilities to build MRO into the Opcenter product as well. They are working with existing customers to capture the nuance required to provide an MRO solution for A&D, for example, planning is very different from using a Bill of Process (BOP) for production vs an MRO service plan, which involves not only quasi-production work, such as upgrading field-based equipment to the latest engineering changes, and scheduled maintenance, but also requires support for unplanned repairs.

The long-term key to SLM success is maintaining an unbroken digital thread between as-designed, as-planned, as-produced, and as-maintained for all product parts and assemblies. This is a tall order, though Siemens claims to be the only vendor that meets DoD needs for MBE to cover things like the overall flow from product design to execution regarding PMI and characteristics, as well as the flow back of that information. It will be interesting to see how meeting these requirements translates into actual success with DoD suppliers that have a lot of compartmentalized thinking and complex supply chains with varying levels of compliance and sophistication.

AI is the topic du jour across all of technology, and Siemens Digital Industries Software is no different (as reported by Tech-Clarity in “Siemens Realize LIVE 2025: A Vision for AI, Simulation, and Immersive Engineering in a Connected Digital Thread”). Siemens Opcenter is also adopting these capabilities. This involves Opcenter integration with Insights Hub (formerly Mindsphere). Insights Hub is dedicated to solving specific use cases and integrates with Opcenter to contextualize Opcenter data. Siemens, along with SIs and customers, uses Insights Hub with capabilities such as Copilot Studio to build their own queries and agentic AI.

In addition, they are collaborating with AI startups – Retrocausal, Cybord, Instrumental – on image recognition, defect detection, etc. They are also creating AI-infused applications with Mendix and its connectors. The UIs are based on Mendix so that they can embed AWS Bedrock, for example. A recipe copilot was created to compile documents, specifications, and other required artifacts from formulated designs for pharma and process industries in one recent case. Early customers have reported up to 3 months of productivity gain to get a drug to market.

Thank you Tobias Lange, Ignace Braem, and Shaun Ennis for this detailed and interesting briefing.