How can manufacturers develop a digital thread and unlock the business value necessary to stay competitive? Today’s manufacturers operate in an environment defined by compressed timelines, increasing product complexity, and heightened customer expectations. Success depends on the ability to move quickly without sacrificing quality, compliance, or profitability. To achieve this, organizations must enable seamless collaboration…

- The Chaotic Status Quo

- Chaos Hampers Productivity

- Connect Product Data

- CAD Can Serve as the Foundation

- Unmanaged CAD Data is Costly

- It's Time to Unlock CAD Data

- More Data Shared with More People

- Connect Product Data to PLM

- Extend PLM to the Enterprise

- Establish the Product Digital Thread

- Additional Considerations

- Get Started

- Acknowledgments

A Digital Thread for Greater Speed and Agility

Business Complexities Drive Need for a Digital Thread Manufacturers of all sizes are under pressure to rapidly deliver innovative products while meeting increased customer expectations, designing more complex products, and staying ahead of market demands. For manufacturers, business agility and getting products to market quickly can determine profitability, or even whether they stay in business. Product companies require operational efficiency that fosters collaboration, enables faster and smarter decision-making, and ensures synchronization with the supply chain. Picture all of the teams and people bringing a new product to market, accessing the same, accurate, up-to-date product information. To make this happen, manufacturers must establish a product digital thread throughout the organization and product lifecycle. How can manufacturers develop a digital thread and unlock the business value necessary to stay competitive? Keep reading to find out what a product lifecycle management (PLM)-enabled digital thread is, why it is needed, and how to build one.

The Chaotic Status Quo

New Product Development is More Complex

For manufacturers, delivering profitable products to the market has become significantly harder. Products are more complex than ever, requiring additional resources with expertise in new disciplines, driving up development costs, and putting profit margins at risk.

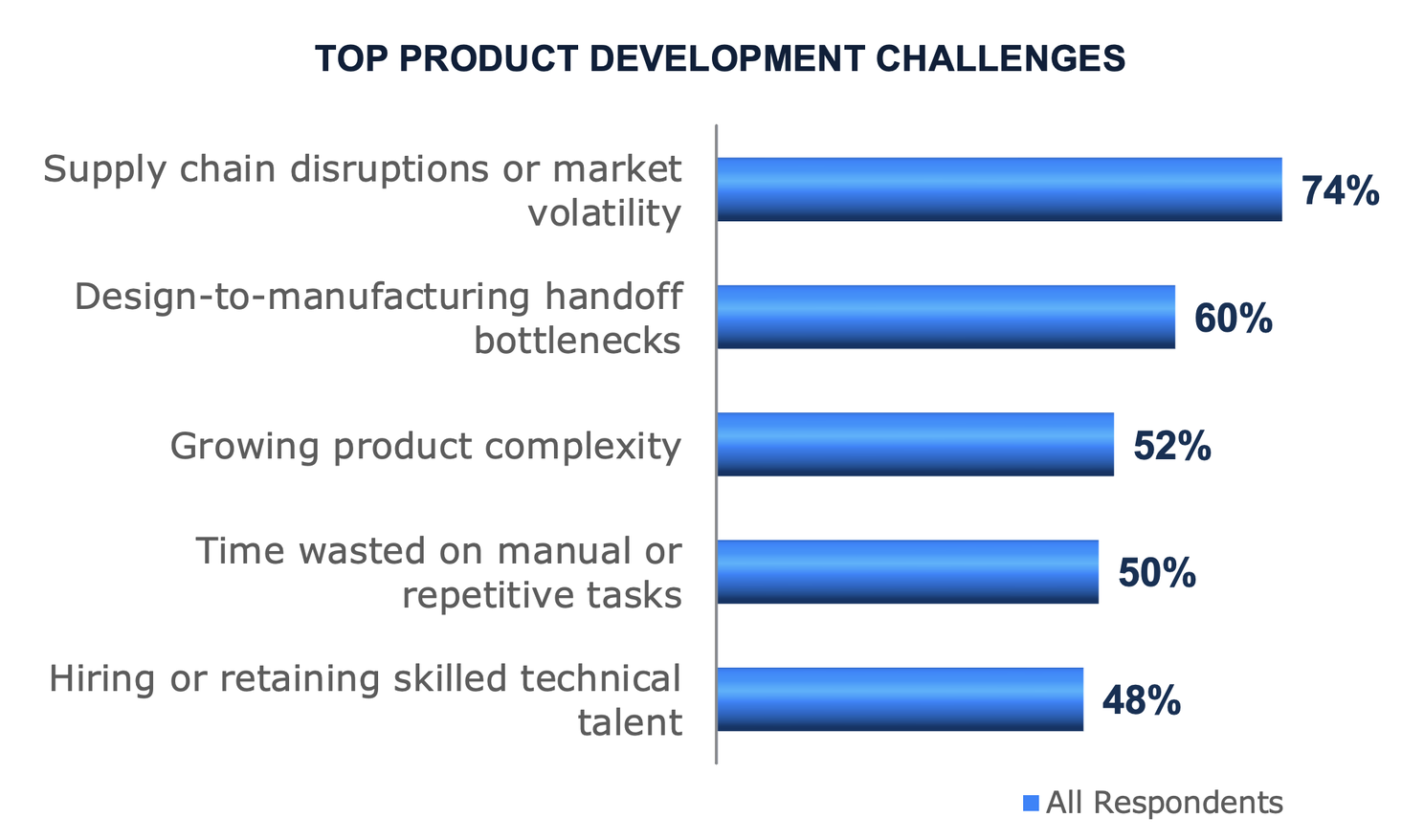

The Heightened Impact of External Pressures

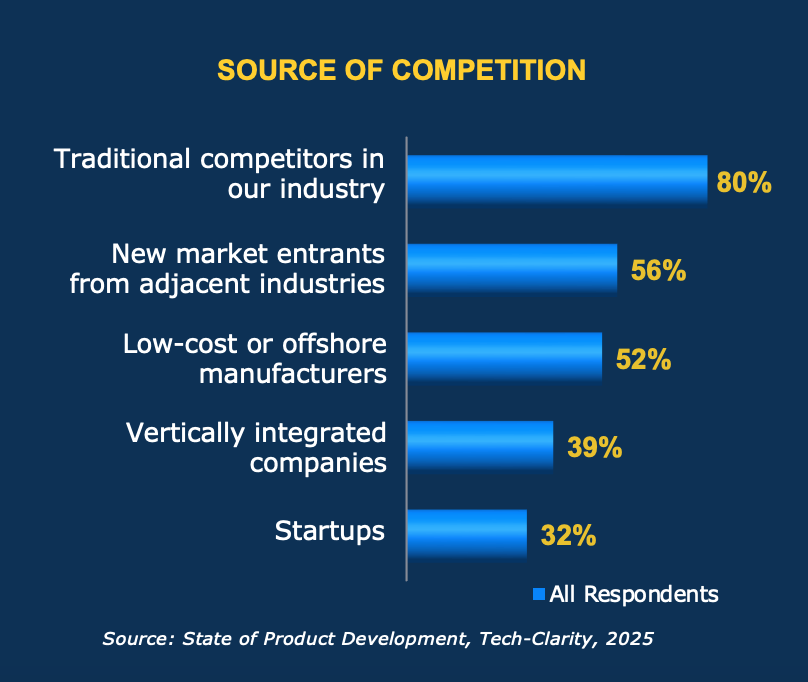

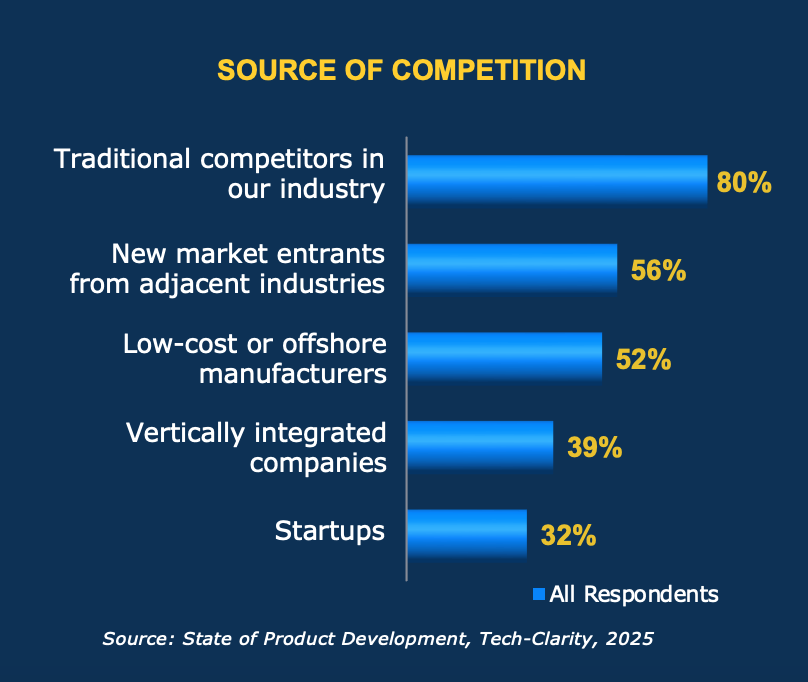

Some of this complexity arises from external factors outside a manufacturer’s control. Customers are increasingly demanding, expecting innovative products more quickly than ever before. Competition is coming from all directions. Not only from traditional competitors, but also from new entrants. Our State of Product Development survey found that 56% of manufacturers face competition from adjacent industries, while 52% compete with low-cost or offshore manufacturers.1 Today’s supply chains add to the challenge. In fact, 74% of manufacturers in the survey identified supply chain disruptions or market volatility as a top challenge in product development.2 Beyond that, government and industry regulations are widespread, especially in High Tech and medical technology, demanding strict engineering and quality processes with thorough data collection and management.

Multi-CAD Environment Complicates Design Collaboration

Some of the complexity stems from internal issues. Remember when products were primarily mechanical?

Those days are gone. Now, mechanical, electrical, and software teams all need to work together – and be productive doing it. They must ensure that form, fit, and function all work in harmony while delivering their designs on the same development and launch timeline.

However, each design discipline uses different tools, with product data stored and managed separately or, in the worst case, only on an individual engineer's drives. Managing and accessing product data across multiple design systems, let alone file folders and shared drives, negatively impacts collaboration and reduces productivity.

New Product Development is More Complex

For manufacturers, delivering profitable products to the market has become significantly harder. Products are more complex than ever, requiring additional resources with expertise in new disciplines, driving up development costs, and putting profit margins at risk.

The Heightened Impact of External Pressures

Some of this complexity arises from external factors outside a manufacturer’s control. Customers are increasingly demanding, expecting innovative products more quickly than ever before. Competition is coming from all directions. Not only from traditional competitors, but also from new entrants. Our State of Product Development survey found that 56% of manufacturers face competition from adjacent industries, while 52% compete with low-cost or offshore manufacturers.1 Today’s supply chains add to the challenge. In fact, 74% of manufacturers in the survey identified supply chain disruptions or market volatility as a top challenge in product development.2 Beyond that, government and industry regulations are widespread, especially in High Tech and medical technology, demanding strict engineering and quality processes with thorough data collection and management.

Multi-CAD Environment Complicates Design Collaboration

Some of the complexity stems from internal issues. Remember when products were primarily mechanical?

Those days are gone. Now, mechanical, electrical, and software teams all need to work together – and be productive doing it. They must ensure that form, fit, and function all work in harmony while delivering their designs on the same development and launch timeline.

However, each design discipline uses different tools, with product data stored and managed separately or, in the worst case, only on an individual engineer's drives. Managing and accessing product data across multiple design systems, let alone file folders and shared drives, negatively impacts collaboration and reduces productivity.

Establish the Product Digital Thread

Where to Start

For some manufacturers, establishing a digital thread may be viewed as out of reach when facing budget, resources, and time constraints. However, manufacturers can establish a digital thread despite these challenges.

Use 80-20 Rule

Applying the 80-20 rule helps focus on the most important and common use cases and workflows first. These deliver the most significant business value without getting bogged down with less common and more complicated edge cases. In short, keep it simple.

Keep Established Workflows

Established workflows need to continue, especially those supporting regulatory requirements, but avoid excessive customization whenever possible. Using out-of-the-box functionality saves implementation time and money, and reduces the need for dedicated IT resources.

Connect Existing Systems

There is no need to start from scratch. A practical approach is to connect existing CAD, PDM, and PLM investments and applications that are working well to create the product digital thread.

Take a Phased Approach

The best path is to take it one step at a time. Since data across systems is probably not perfectly aligned, a phased approach to PDM-PLM integration is preferred. Start with a small project, or assembly, to avoid a massive data cleanup upfront. Then add new projects and products as data cleansing progresses.

*This summary is an abbreviated version of the eBook and does not contain the full content. For the full research, please visit our sponsor, Propel (registration required).

If you have difficulty obtaining a copy of the research, please contact us.

[post_title] => Building the Digital Thread to Improve NPD Performance

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => digital-thread

[to_ping] =>

[pinged] =>

[post_modified] => 2026-02-20 10:50:20

[post_modified_gmt] => 2026-02-20 15:50:20

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23514

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[1] => WP_Post Object

(

[ID] => 23503

[post_author] => 2

[post_date] => 2026-02-19 09:59:01

[post_date_gmt] => 2026-02-19 14:59:01

[post_content] =>

Where to Start

For some manufacturers, establishing a digital thread may be viewed as out of reach when facing budget, resources, and time constraints. However, manufacturers can establish a digital thread despite these challenges.

Use 80-20 Rule

Applying the 80-20 rule helps focus on the most important and common use cases and workflows first. These deliver the most significant business value without getting bogged down with less common and more complicated edge cases. In short, keep it simple.

Keep Established Workflows

Established workflows need to continue, especially those supporting regulatory requirements, but avoid excessive customization whenever possible. Using out-of-the-box functionality saves implementation time and money, and reduces the need for dedicated IT resources.

Connect Existing Systems

There is no need to start from scratch. A practical approach is to connect existing CAD, PDM, and PLM investments and applications that are working well to create the product digital thread.

Take a Phased Approach

The best path is to take it one step at a time. Since data across systems is probably not perfectly aligned, a phased approach to PDM-PLM integration is preferred. Start with a small project, or assembly, to avoid a massive data cleanup upfront. Then add new projects and products as data cleansing progresses.

*This summary is an abbreviated version of the eBook and does not contain the full content. For the full research, please visit our sponsor, Propel (registration required).

If you have difficulty obtaining a copy of the research, please contact us.

[post_title] => Building the Digital Thread to Improve NPD Performance

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => digital-thread

[to_ping] =>

[pinged] =>

[post_modified] => 2026-02-20 10:50:20

[post_modified_gmt] => 2026-02-20 15:50:20

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23514

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[1] => WP_Post Object

(

[ID] => 23503

[post_author] => 2

[post_date] => 2026-02-19 09:59:01

[post_date_gmt] => 2026-02-19 14:59:01

[post_content] =>

Revisiting the future of PLM in Consumer Packaged Goods in the Age of AI

In 2022 Tech-Clarity, Kalypso, and PepsiCo discussed the future of PLM in CPG based on a Tech-Clarity survey on the state of CPG PLM. So much has changed over the last several years. Even then, the majority of companies felt their existing PLM wasn't ready to meet their future needs. Now, AI is broadening the gap.- What did we get right and what did we miss?

- Is PLM reaching its strategic value as a platform or limited to cost and compliance?

- Are today’s PLM implementations better suited to meet future needs?

- How does a composable PLM approach help increase value?

- How has increased AI adoption changed PLM value? PLM requirements?

Can highly regulated pharmaceutical companies use AI effectively? What are companies doing to leverage AI without compromising their CGMP-validated processes? Please join this practical, real-world conversation on moving AI beyond pilots and into meaningful results.

Tech-Clarity’s Julie Fraser joins with Kate Porter, Director of Product Management and Research at POMS, along with a customer. Roland Esquivel, POMS VP of Sales and Marketing will moderate the discussion and lend his experience also. This diverse panel will discuss what is already working and where regulatory, quality, IT, and other questions and challenges lie.

The discussion will touch on these topics:

Can highly regulated pharmaceutical companies use AI effectively? What are companies doing to leverage AI without compromising their CGMP-validated processes? Please join this practical, real-world conversation on moving AI beyond pilots and into meaningful results.

Tech-Clarity’s Julie Fraser joins with Kate Porter, Director of Product Management and Research at POMS, along with a customer. Roland Esquivel, POMS VP of Sales and Marketing will moderate the discussion and lend his experience also. This diverse panel will discuss what is already working and where regulatory, quality, IT, and other questions and challenges lie.

The discussion will touch on these topics:

- What pharma manufacturers are trying to achieve with AI and why outcomes vary

- Real-world examples of where AI is working today in manufacturing operations

- Lessons from AI initiatives that stalled or failed to scale

- Why Proof of Concept efforts often fall short and how to approach them differently

- The organizational elements successful teams put in place before AI scales

- Key questions leaders and teams should ask before investing in AI

- Technology insights from the field on what accelerates and what slows AI adoption

How do manufacturers integrate design data (PLM) with manufacturing data (MES)?

Tech-Clarity invites you to join a research study on PLM-MES Integration. Please take about 10 minutes to fill out our survey. As a thank you, we will send you a copy of the report summarizing the findings.

How do manufacturers integrate design data (PLM) with manufacturing data (MES)?

Tech-Clarity invites you to join a research study on PLM-MES Integration. Please take about 10 minutes to fill out our survey. As a thank you, we will send you a copy of the report summarizing the findings.

In addition, eligible respondents will be entered into a drawing for one of twenty $25 Amazon gift cards. See the survey for eligibility details.

Take the survey now to share your perspective! Please feel free to forward this survey to others you feel have an opinion to share. Individual responses will be kept confidential.

Thank you for your support, please check out our Active Research page for additional Tech-Clarity survey opportunities.

[post_title] => How are Manufacturing Leaders Integrating PLM and MES?

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => plm-mes-2

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-28 10:38:35

[post_modified_gmt] => 2026-01-28 15:38:35

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23446

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 23455

[post_author] => 2574

[post_date] => 2026-01-26 10:00:40

[post_date_gmt] => 2026-01-26 15:00:40

[post_content] =>

In addition, eligible respondents will be entered into a drawing for one of twenty $25 Amazon gift cards. See the survey for eligibility details.

Take the survey now to share your perspective! Please feel free to forward this survey to others you feel have an opinion to share. Individual responses will be kept confidential.

Thank you for your support, please check out our Active Research page for additional Tech-Clarity survey opportunities.

[post_title] => How are Manufacturing Leaders Integrating PLM and MES?

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => plm-mes-2

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-28 10:38:35

[post_modified_gmt] => 2026-01-28 15:38:35

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23446

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 23455

[post_author] => 2574

[post_date] => 2026-01-26 10:00:40

[post_date_gmt] => 2026-01-26 15:00:40

[post_content] =>

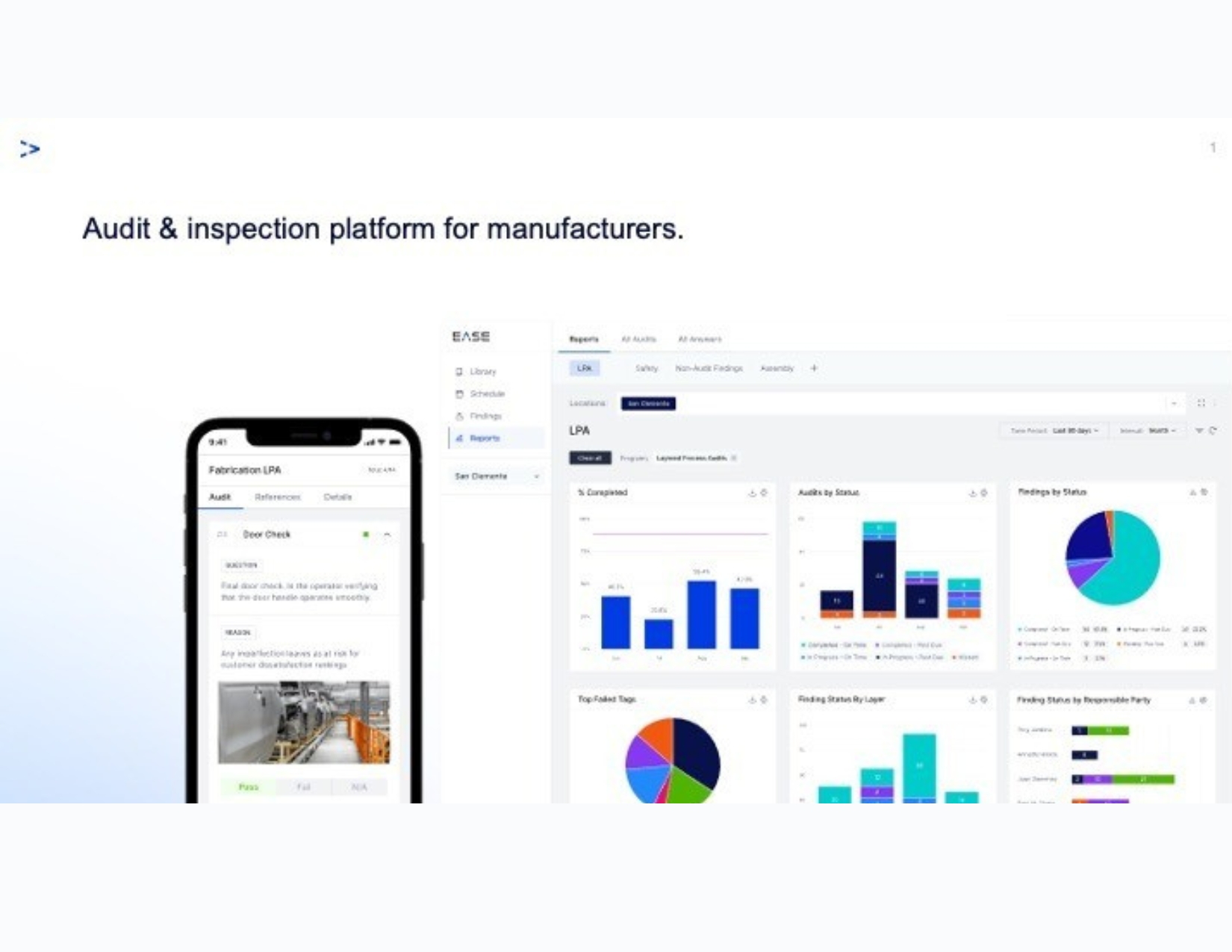

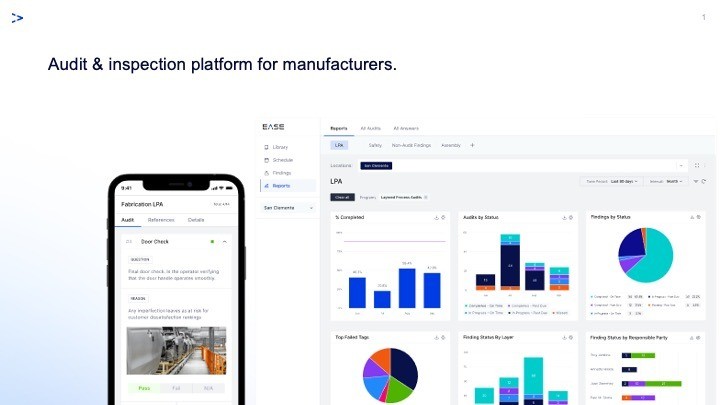

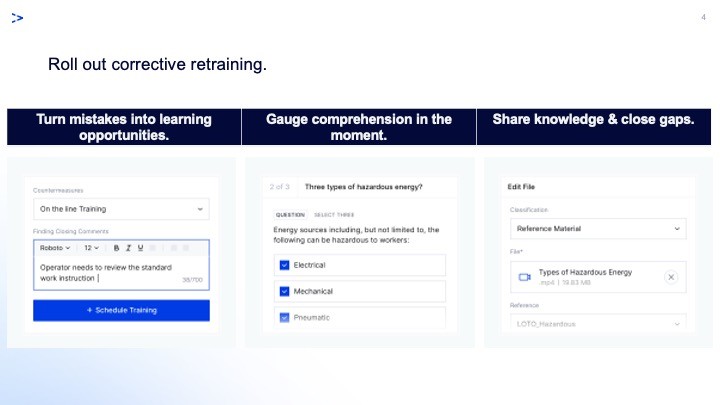

How can a strong auditing program, as practiced in major automotive suppliers, improve? By going digital. Ease.io as been doing that for years, with a SaaS software platform for Layered Process Audits (LPAs), 5S, Safety Inspections, Gemba walks, Root Cause Analysis (RCA), and problem-solving. They recently added on-the-job (OTJ) training support to strengthen customers’ outcomes.

Standardizing and Digitalizing Audit Practices

Many lean and operational excellence programs include regular audits. Audits are designed to improve quality, productivity, and safety, and nearly always do. However, using paper, spreadsheets, tribal knowledge, and legacy or homegrown software can create inefficiencies and missed opportunities. For example, if standard processes are not executed consistently or when follow-ups to issues are slow, manufacturing issues can arise and cause problems.

For over 10 years, EASE has been selling software to support these process audit activities. Customers report vastly increased audit completion rates, with up to a 90% reduction in leadtime for major audits. Allowing data to flow smoothly with less administrative burden can help LPA and other audit processes deliver their value with minimal non-value-added overhead.

New Thinking, Digital Support

Manufacturers adopting a digital platform may encounter early resistance from end-users to the change in how audits have been conducted in the past. EASE encourages customers to explore how new technologies enable them to rethink how they do things. Using integrated technology can also help identify all trends and breakdowns. It also helps to trace the root causes of problems and track whether actions have improved the situation.

One of the most significant benefits of a digital approach is the speed to identify and notify about non-conformances. Another is the ability to make audits more effective, consistent, and visible. The digital record also makes it easier to detect when corrective actions have not had the expected impact, to re-address needed issues, and truly close the loop to optimize outcomes.

Supporting Training – A New Level of EASE

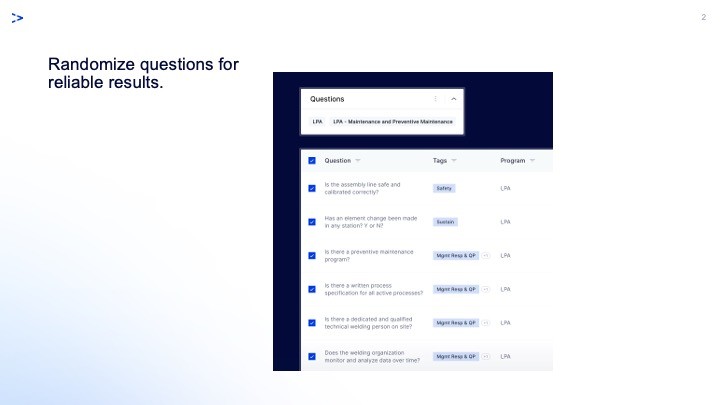

EASE is available as a SaaS subscription. The base audit & inspection version of EASE supports mobile audit and inspection checklist authoring through both pulling existing checklists and creating new ones. It also incorporates automated scheduling, findings management, and real-time data and dashboards for clear visuals of audit results. Naturally, EASE must connect to the systems of record, including QMS, MES, and CMMS. EASE Connect also enables bulk data access for BI tools and dashboarding, while Insights is their own dashboard solution that delivers custom-built dashboards specific to individual customers.

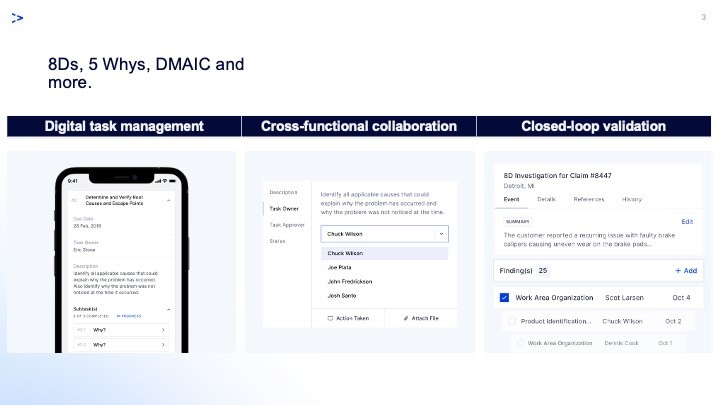

The next Level of EASE subscription includes creation and management of action plans. Action plans support collaborative RCA and analysis to document and facilitate problem investigation and understanding. Here, the EASE solution enables customers to create a library of guided problem-solving processes, milestones, and tasks. Then, the customer sets an action plan based on findings, assigning owners and approvers to each task along with due dates. Finally, this enables monitoring progress and scheduling validation tasks for sustained corrective actions.

A new release from summer 2025 includes OTJ capabilities. In performing corrective actions, EASE saw a way to facilitate training. As operator errors and poor training are shared drivers of non-conformances across the customer base, this became a clear need. Customers generate training from existing documents and publish it as contextual training that is triggered from findings. It can accommodate individual or group training, quiz users, and require sign-offs after training, also checking whether it addressed the issue. With the current “gray tsunami” of knowledgeable workers retiring, this need is only increasing.

Broad Use and Impact

EASE reports that customers have achieved excellent results. These include a 20% decrease in the cost of poor quality, a 2% improvement in OEE, and a 67% decrease in time to close out findings. Better audits and process improvements lead to lower cost of poor quality, higher productivity, and improved labor efficiency.

EASE claims to have over 350 customers using EASE in more than 3,500 plants across 60 countries. Customers are in the automotive, aerospace and defense, furniture, and a range of both process and discrete manufacturing industries. It appears that in these companies, use is also growing, as EASE reports that the platform now supports over four million audits each year.

We look forward to following EASE’s continued progress and growth in the manufacturing markets. Clearly this company Is helping manufacturers rethink and improve their audit processes. Ironically, Julie Fraser met Ease.io at the Manufacturing Leadership Council’s Rethink 2025 event. Thank you, Josh Santo, John Fredrickson, and Andrea Walter, for the briefing!

[post_title] => EASE Grows by Accelerating Audits Worldwide [post_excerpt] => [post_status] => publish [comment_status] => open [ping_status] => open [post_password] => [post_name] => ease-audits [to_ping] => [pinged] => [post_modified] => 2026-02-04 16:29:14 [post_modified_gmt] => 2026-02-04 21:29:14 [post_content_filtered] => [post_parent] => 0 [guid] => https://tech-clarity.com/?p=23455 [menu_order] => 0 [post_type] => post [post_mime_type] => [comment_count] => 0 [filter] => raw ) [5] => WP_Post Object ( [ID] => 23436 [post_author] => 2 [post_date] => 2026-01-20 09:38:50 [post_date_gmt] => 2026-01-20 14:38:50 [post_content] => How are manufacturers approaching the AI opportunity?

We invite you to join our research study on the challenges, capabilities, and future plans manufacturers and supporting engineering (EPC) companies have for Artificial Intelligence (AI). Please take about 10 to 15 minutes to complete this short survey to share your perspective.

All individual responses will be kept confidential. Thank you for helping us understand and shape the future of AI.

As a thank you for your time, Tech-Clarity will share a copy of the final results with you.

[post_title] => AI Maturity in Manufacturing and EPC

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => ai-in-manufacturing

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-20 09:38:50

[post_modified_gmt] => 2026-01-20 14:38:50

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23436

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[6] => WP_Post Object

(

[ID] => 23413

[post_author] => 2572

[post_date] => 2026-01-14 10:13:06

[post_date_gmt] => 2026-01-14 15:13:06

[post_content] =>

How are manufacturers approaching the AI opportunity?

We invite you to join our research study on the challenges, capabilities, and future plans manufacturers and supporting engineering (EPC) companies have for Artificial Intelligence (AI). Please take about 10 to 15 minutes to complete this short survey to share your perspective.

All individual responses will be kept confidential. Thank you for helping us understand and shape the future of AI.

As a thank you for your time, Tech-Clarity will share a copy of the final results with you.

[post_title] => AI Maturity in Manufacturing and EPC

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => ai-in-manufacturing

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-20 09:38:50

[post_modified_gmt] => 2026-01-20 14:38:50

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23436

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[6] => WP_Post Object

(

[ID] => 23413

[post_author] => 2572

[post_date] => 2026-01-14 10:13:06

[post_date_gmt] => 2026-01-14 15:13:06

[post_content] =>  If you are in the semiconductor industry, do you have the right development and manufacturing solution to scale the business to meet growing demand?

The semiconductor industry is entering a period of rapid growth, driven by AI, electric vehicles, autonomous systems, industrial connectivity, and rising data demands. To capitalize on this opportunity, semiconductor companies must scale to meet growing demand.

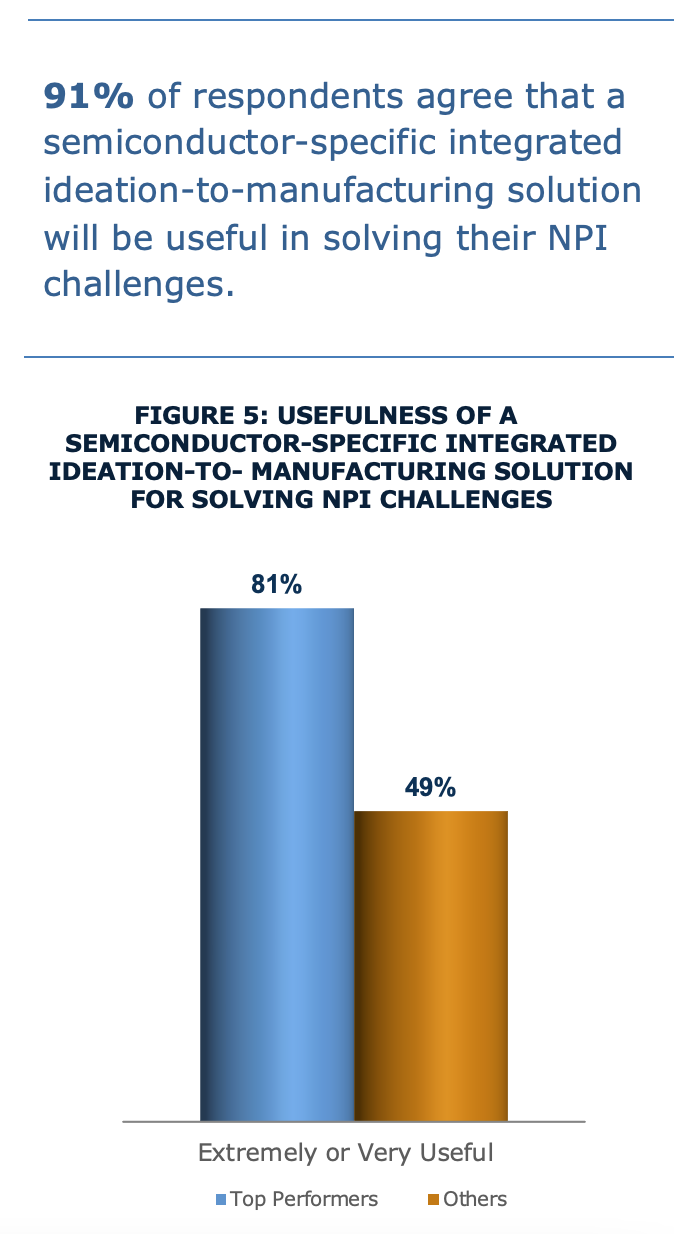

Yet, nearly all semiconductor companies report challenges with New Product Introduction (NPI), often caused by disconnected processes, limited visibility, and tools that don’t scale. Top Performers are addressing these issues by investing in digitalization and adopting PLM platforms tailored for semiconductor development. What should semiconductor companies consider to select the right solution?

Based on a survey of 207 semiconductor and high-tech professionals, the Buyer’s Guide for Semiconductor Development: Ideation through Manufacturing outlines key buying criteria across four critical areas: software functionality, service and implementation support, vendor capabilities, and company-specific needs. Based on expert interviews and survey research, it’s designed to help semiconductor leaders evaluate solutions to invest in the tools that will support scalable, profitable growth.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

To learn more about the business value of investing in development and manufacturing processes, read our survey-based research report, Three Ways Semiconductor Companies Can Prepare for Profitable Growth.

If you are in the semiconductor industry, do you have the right development and manufacturing solution to scale the business to meet growing demand?

The semiconductor industry is entering a period of rapid growth, driven by AI, electric vehicles, autonomous systems, industrial connectivity, and rising data demands. To capitalize on this opportunity, semiconductor companies must scale to meet growing demand.

Yet, nearly all semiconductor companies report challenges with New Product Introduction (NPI), often caused by disconnected processes, limited visibility, and tools that don’t scale. Top Performers are addressing these issues by investing in digitalization and adopting PLM platforms tailored for semiconductor development. What should semiconductor companies consider to select the right solution?

Based on a survey of 207 semiconductor and high-tech professionals, the Buyer’s Guide for Semiconductor Development: Ideation through Manufacturing outlines key buying criteria across four critical areas: software functionality, service and implementation support, vendor capabilities, and company-specific needs. Based on expert interviews and survey research, it’s designed to help semiconductor leaders evaluate solutions to invest in the tools that will support scalable, profitable growth.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

To learn more about the business value of investing in development and manufacturing processes, read our survey-based research report, Three Ways Semiconductor Companies Can Prepare for Profitable Growth.

Table of Contents

- Executive Overview

- Empowering Growth

- Overcome Data and Process Management Challenges

- Ideal Development Solution for Semiconductor

- Use an Effective Semiconductor Data Model

- Leverage the Data Model with the Right Capabilities

- Manage Lifecycle Processes

- Implementation Requirements

- Vendor Requirements

- Identify Unique Company Need

- Conclusions

- Recommendations

- Acknowledgments

- About the Author

Executive Overview

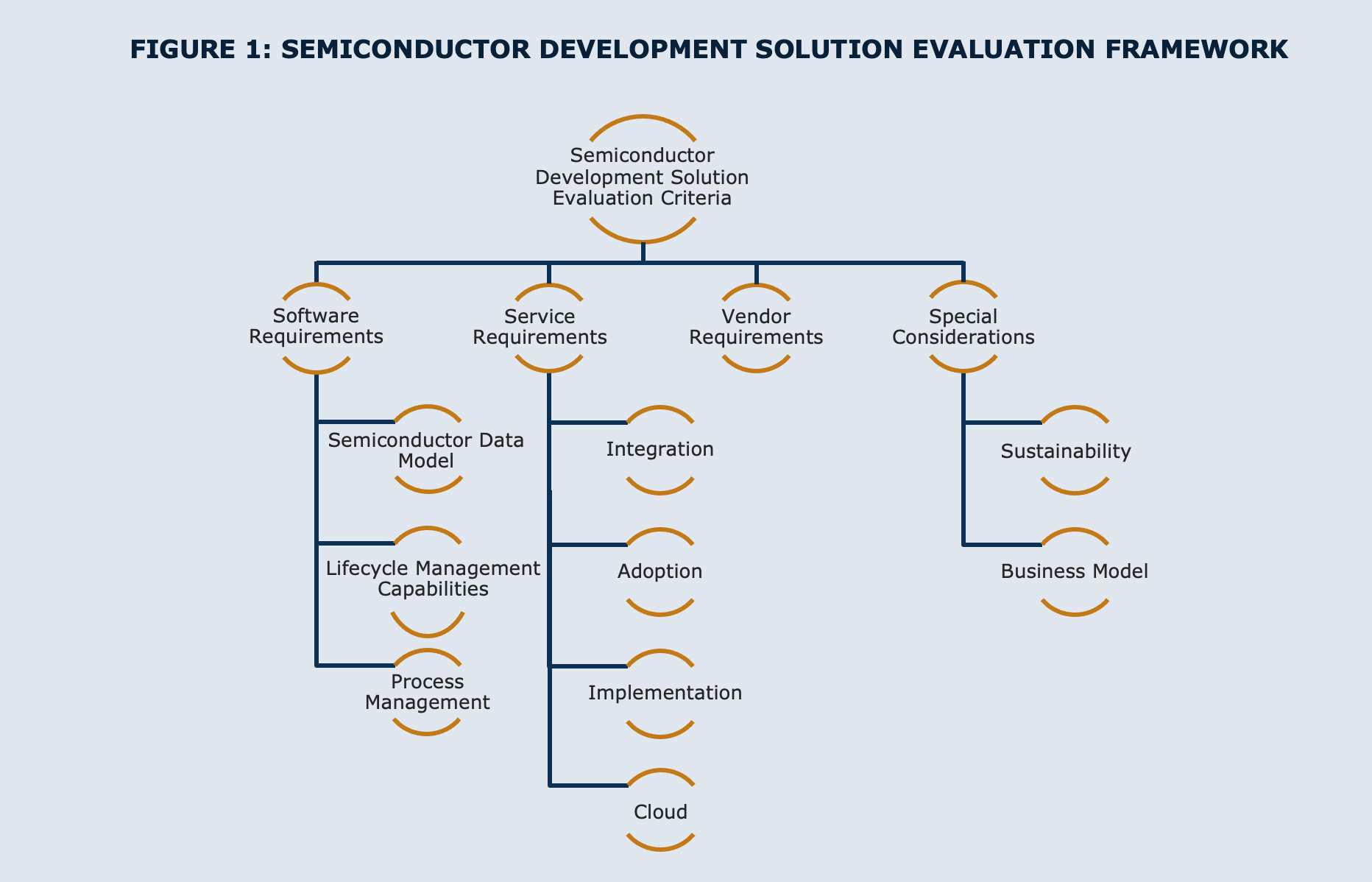

The semiconductor industry is poised for significant growth, fueled by advancements in artificial intelligence (AI), investments in electric vehicles, innovations in autonomous driving, enhanced industrial connectivity, and the rising demand for data storage. This is creating substantial opportunities for the sector, which is reflected in the impressive 19% year-over-year increase in semiconductor global sales in 2024. This double-digit growth is expected to continue as forecasts project that the market could soar to $1 trillion by 2030. To capitalize on this momentum, semiconductor companies are expanding into new markets, diversifying portfolios, and accelerating time to market. To succeed with these goals, they will need to build on their existing expertise and scale their operations. Top Performing semiconductor companies are supporting their growth by adopting Product Lifecycle Management (PLM) solutions, advancing digitalization, and improving process efficiency. Yet, growth comes with challenges. Nearly all surveyed semiconductor companies (99%) report difficulties with New Product Introduction (NPI). Additionally, customer expectations for faster NPI and high-quality products have increased since 2020. Many struggle with disconnected processes, limited visibility, and solutions that don’t scale, placing the burden on internal teams. The right PLM platform, tailored for the semiconductor industry, can help businesses overcome these challenges, while empowering them to achieve their goals. This buyer’s guide outlines the capabilities needed in a PLM solution tailored for semiconductor development. It includes checklists across four areas: software functionality, services, vendor attributes, and company-specific needs (Figure 1). Insights are drawn from a survey of 207 semiconductor and high-tech professionals on the tools and approaches that drive the most business value.

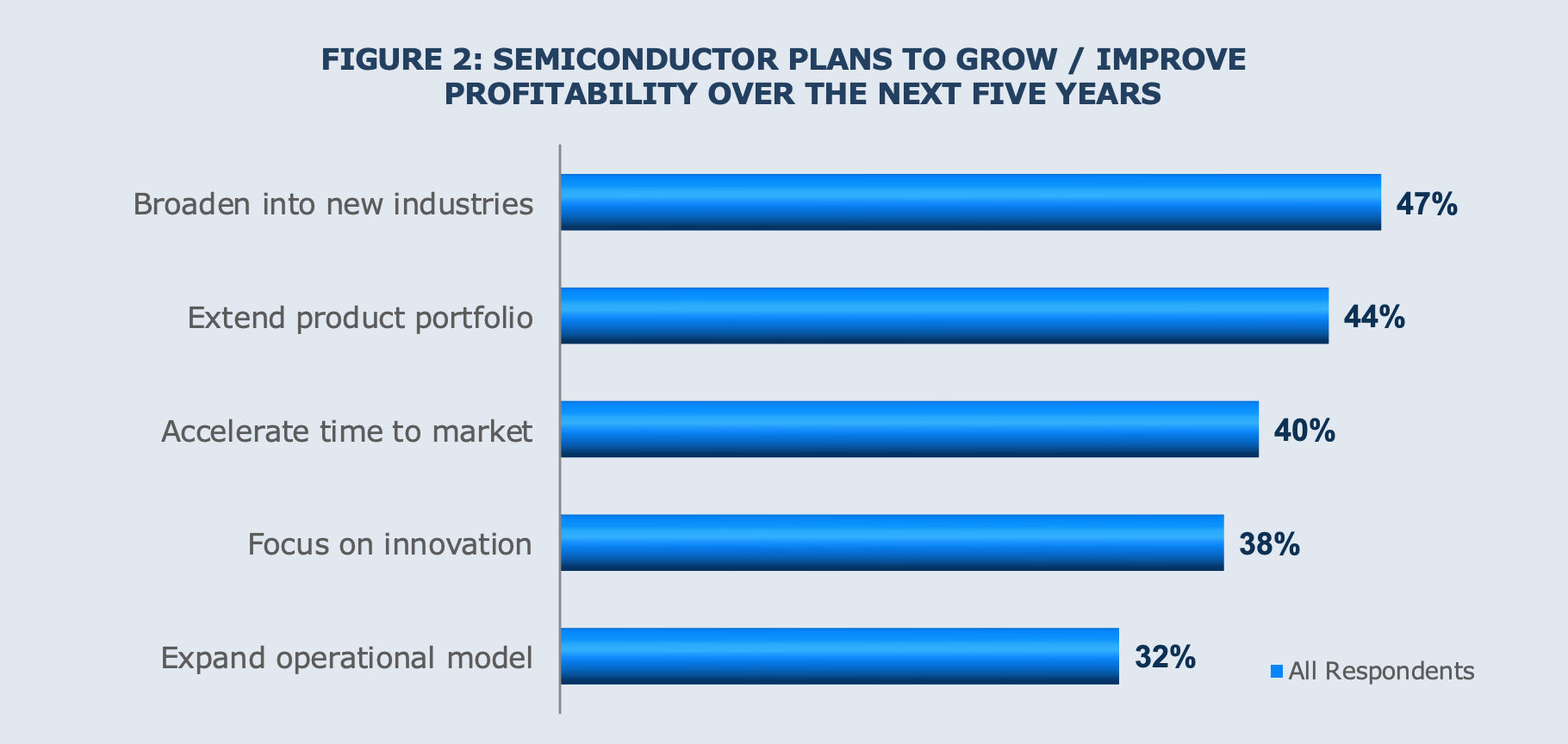

Empowering Growth

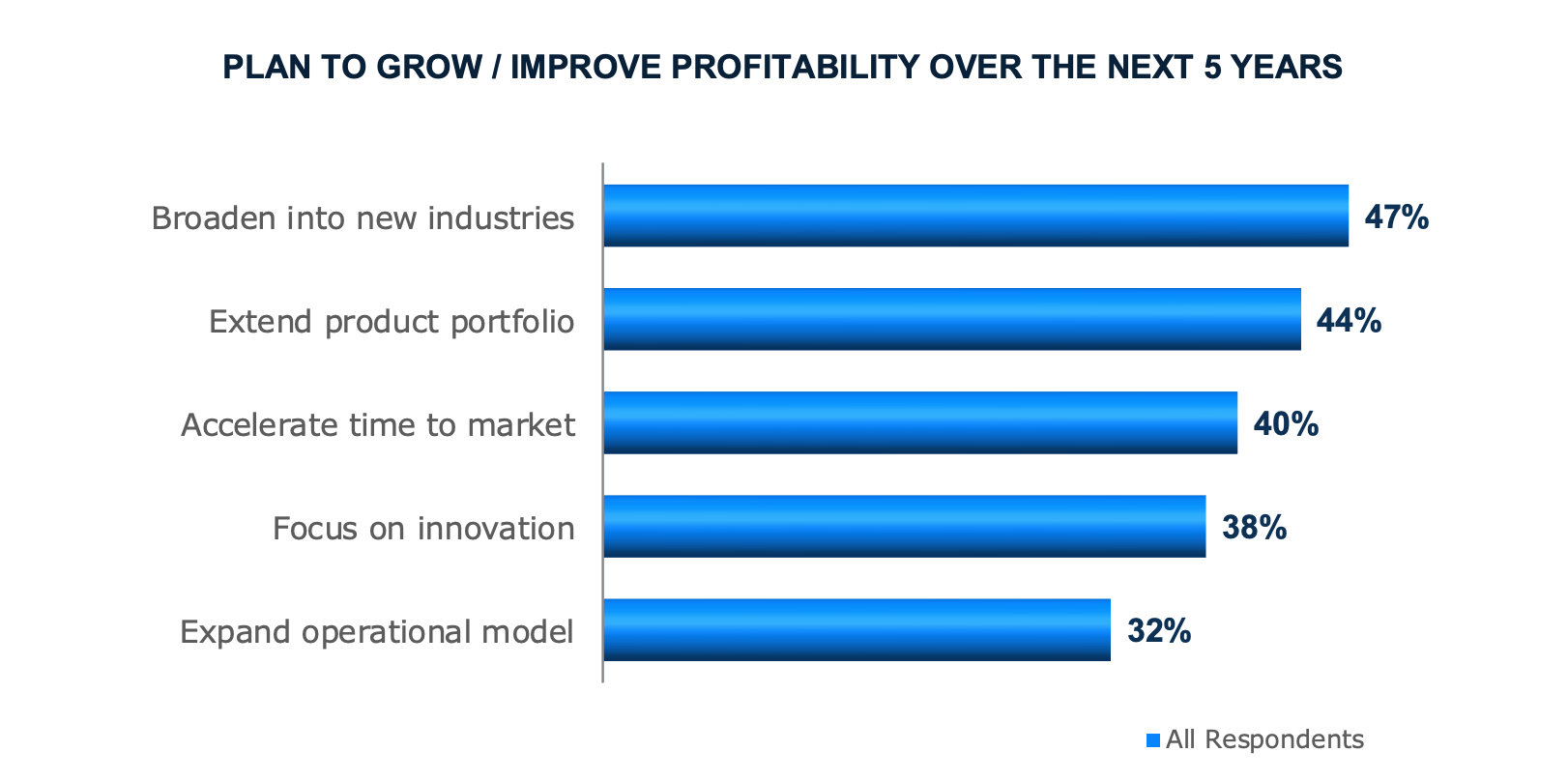

To stay profitable over the next five years, semiconductor companies are targeting new industries, expanding product portfolios, accelerating time to market, boosting innovation, and evolving their operational models (see graph). By diversifying into different industries and broadening their portfolios, semiconductor companies can adapt their existing expertise and innovations for new applications and high-growth areas that require specialized chips like AI, electric vehicles, and autonomous driving. Not only does this open new revenue streams, but it also reduces development costs and improves margins. It also helps offset demand shifts, such as slowing mobile phone sales.

However, managing multiple product lines adds complexity, necessitating efficient processes to encourage reuse and streamline development. Improving how they manage and integrate data can help.

By diversifying into different industries and broadening their portfolios, semiconductor companies can adapt their existing expertise and innovations for new applications and high-growth areas that require specialized chips like AI, electric vehicles, and autonomous driving. Not only does this open new revenue streams, but it also reduces development costs and improves margins. It also helps offset demand shifts, such as slowing mobile phone sales.

However, managing multiple product lines adds complexity, necessitating efficient processes to encourage reuse and streamline development. Improving how they manage and integrate data can help.

Ideal Development Solution for Semiconductor

To uncover what drives leading performance, Tech-Clarity surveyed 207 semiconductor and high-tech professionals and identified “Top Performers” as the top 25% that outperform their competitors in metrics that indicate business success. These metrics were:

To uncover what drives leading performance, Tech-Clarity surveyed 207 semiconductor and high-tech professionals and identified “Top Performers” as the top 25% that outperform their competitors in metrics that indicate business success. These metrics were:

- Revenue growth over the last 24 months

- Profit margin expansion over the previous 24 months

- Percent of sales from new products

- Product cost reduction over the last 24 months

- Greater project visibility

- Better risk management

- Enhanced NPI efficiency

Recommendations

Based on industry experience and research for this report, Tech-Clarity offers the following recommendations:- Plan for long-term growth and scalability across product lines, departments, and engineering silos.

- Use high-level requirements such as those in this guide to evaluate solutions based on business fit before engaging in detailed evaluations.

- Choose a solution that supports the unique workflows of the semiconductor industry.

- Ensure the solution covers all lifecycle stages to support NPI, product and characterization requirements, IP management, technology development, chip design, tapeout and mask management, and BOI and BOP management.

- Invest in digital thread capabilities for end-to-end traceability and efficiency.

- Prioritize integration of design and manufacturing data.

- Address the needs of all roles involved, from concept to manufacturing, to drive adoption.

- Select a vendor with semiconductor expertise who can act as a trusted partner.

*This summary is an abbreviated version of the ebook and does not contain the full content. For the full research, please visit our sponsor, Siemens (registration required).

If you have difficulty obtaining a copy of the research, please contact us.

[post_title] => Semiconductor Buyer’s Guide: Ideation through Manufacturing

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => semiconductor-buyers-guide

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-14 10:13:06

[post_modified_gmt] => 2026-01-14 15:13:06

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23413

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[7] => WP_Post Object

(

[ID] => 23383

[post_author] => 2572

[post_date] => 2026-01-13 09:51:56

[post_date_gmt] => 2026-01-13 14:51:56

[post_content] =>

*This summary is an abbreviated version of the ebook and does not contain the full content. For the full research, please visit our sponsor, Siemens (registration required).

If you have difficulty obtaining a copy of the research, please contact us.

[post_title] => Semiconductor Buyer’s Guide: Ideation through Manufacturing

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => semiconductor-buyers-guide

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-14 10:13:06

[post_modified_gmt] => 2026-01-14 15:13:06

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23413

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[7] => WP_Post Object

(

[ID] => 23383

[post_author] => 2572

[post_date] => 2026-01-13 09:51:56

[post_date_gmt] => 2026-01-13 14:51:56

[post_content] =>  How can design engineers balance conflicting time, cost, and quality goals?

As businesses and products grow in complexity, design engineers have much to consider to produce optimal product designs. This is particularly true for smaller and medium-sized businesses (SMBs) that struggle with the same challenges as their larger counterparts, but have fewer resources to address them. What are the most successful SMBs doing to manage this? This research explores this question.

Based on a survey of 230 respondents, this research study examines engineering practices and simulation use. It identifies how executives at SMBs (companies with revenues less than a billion US dollars) can realize higher development returns through simulation-driven design, which should lead to increased profitability.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

How can design engineers balance conflicting time, cost, and quality goals?

As businesses and products grow in complexity, design engineers have much to consider to produce optimal product designs. This is particularly true for smaller and medium-sized businesses (SMBs) that struggle with the same challenges as their larger counterparts, but have fewer resources to address them. What are the most successful SMBs doing to manage this? This research explores this question.

Based on a survey of 230 respondents, this research study examines engineering practices and simulation use. It identifies how executives at SMBs (companies with revenues less than a billion US dollars) can realize higher development returns through simulation-driven design, which should lead to increased profitability.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

Table of Contents

- Executive Summary

- What Does Product Success Mean?

- Business Complexity Creates Engineering Challenges

- Product Complexity Complicates Engineering Decisions

- Identifying Top Performers

- How to Address Growing Complexity

- Addressing Complexity with Technology

- Use Simulation throughout All Lifecycle Stages

- How to Adopt Simulation-Driven Design

- The Business Value of Simulation-Driven Design

- Recommendations

- About the Research

- Acknowledgments

Executive Summary

Increasing Complexity

Engineers have much to consider to design products with the best chance of market success. Products must be high quality, economical, and fast to market. However, as business environments and products become more complex, old ways of working may no longer be enough. Engineers need better methods to navigate the complexity of their engineering and design decisions to meet their goals. This can be especially challenging for a resourced-constrained smaller or medium size business (SMB).

What SMB Top Performers Do

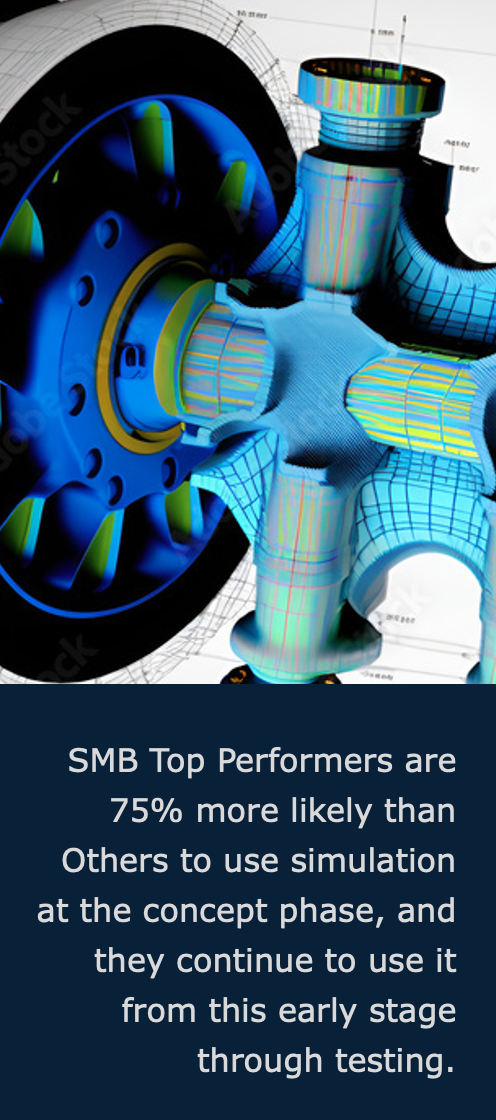

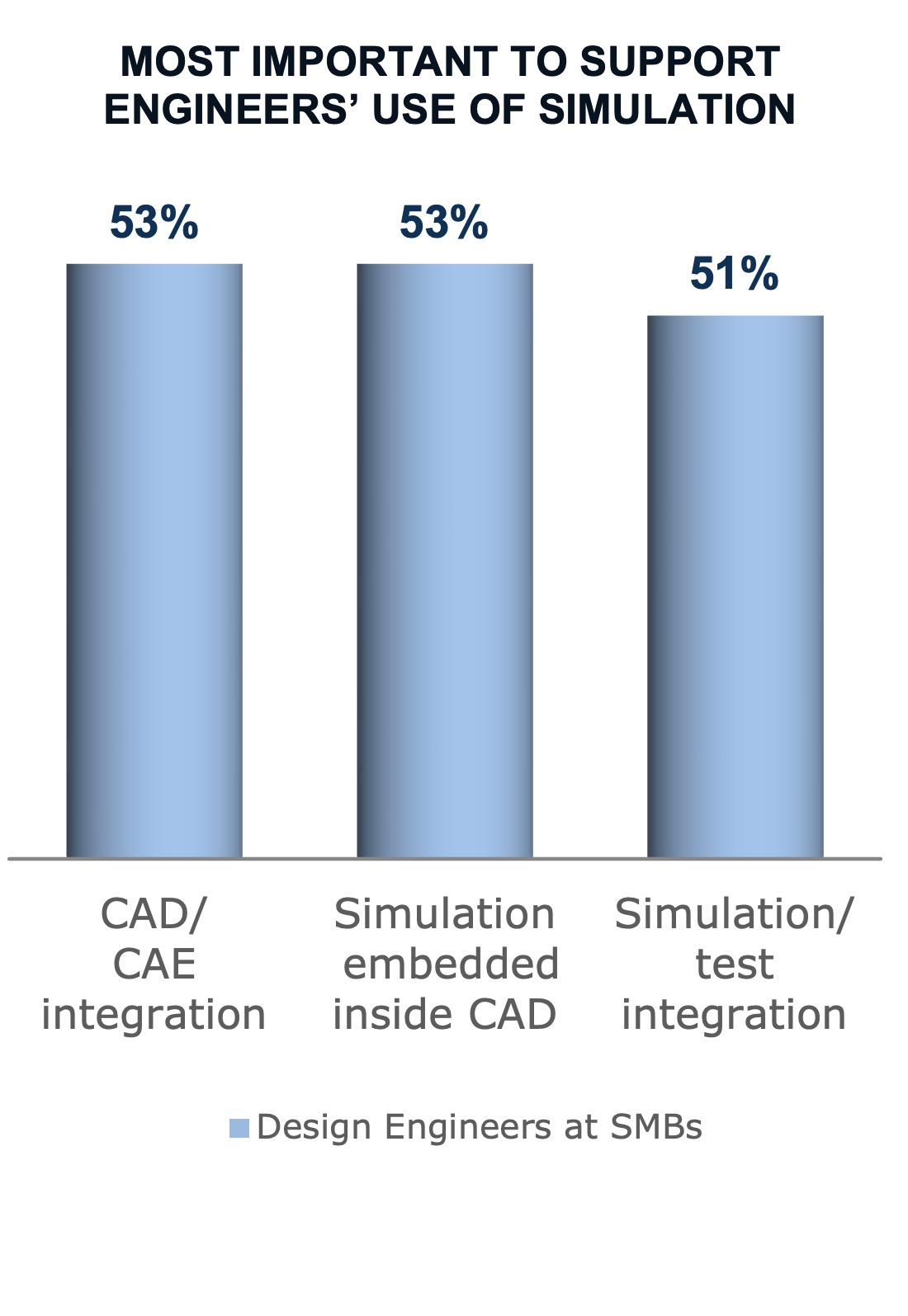

Despite this complexity, Top Performers have implemented practices that allow them to be 2.1 times more likely to have highly effective processes to understand trade-offs. To achieve this, they increase their use of simulation and invest in more software capabilities. Unlike their less successful competitors, they leverage simulation throughout the entire product development lifecycle, supporting a simulation-driven design approach. In fact, SMB Top Performers are 75% more likely than Others to use simulation at the concept phase, and they continue to use it from this early stage through testing.

This is such a powerful approach that 99% of SMBs using simulation to explore design ideas report finding value. They report benefits such as better products, greater productivity, faster innovation, and a higher return on their development investments.

The Right Solution

Part of successfully adopting this approach requires using the right solution and technology. Design engineers report that CAD/CAE integration and embedding simulation inside CAD are the most important solution qualities to support their use of simulation.

This Research Report

This report shares research findings that provide an in-depth look at why today's engineers at SMBs have so much more to consider than they did even just ten years ago. Design decisions are even more complicated, and simply relying on experience is no longer sufficient. The research reveals what the most successful SMBs do to address this, helping them to release more successful products and improve their profitability.

Increasing Complexity

Engineers have much to consider to design products with the best chance of market success. Products must be high quality, economical, and fast to market. However, as business environments and products become more complex, old ways of working may no longer be enough. Engineers need better methods to navigate the complexity of their engineering and design decisions to meet their goals. This can be especially challenging for a resourced-constrained smaller or medium size business (SMB).

What SMB Top Performers Do

Despite this complexity, Top Performers have implemented practices that allow them to be 2.1 times more likely to have highly effective processes to understand trade-offs. To achieve this, they increase their use of simulation and invest in more software capabilities. Unlike their less successful competitors, they leverage simulation throughout the entire product development lifecycle, supporting a simulation-driven design approach. In fact, SMB Top Performers are 75% more likely than Others to use simulation at the concept phase, and they continue to use it from this early stage through testing.

This is such a powerful approach that 99% of SMBs using simulation to explore design ideas report finding value. They report benefits such as better products, greater productivity, faster innovation, and a higher return on their development investments.

The Right Solution

Part of successfully adopting this approach requires using the right solution and technology. Design engineers report that CAD/CAE integration and embedding simulation inside CAD are the most important solution qualities to support their use of simulation.

This Research Report

This report shares research findings that provide an in-depth look at why today's engineers at SMBs have so much more to consider than they did even just ten years ago. Design decisions are even more complicated, and simply relying on experience is no longer sufficient. The research reveals what the most successful SMBs do to address this, helping them to release more successful products and improve their profitability.

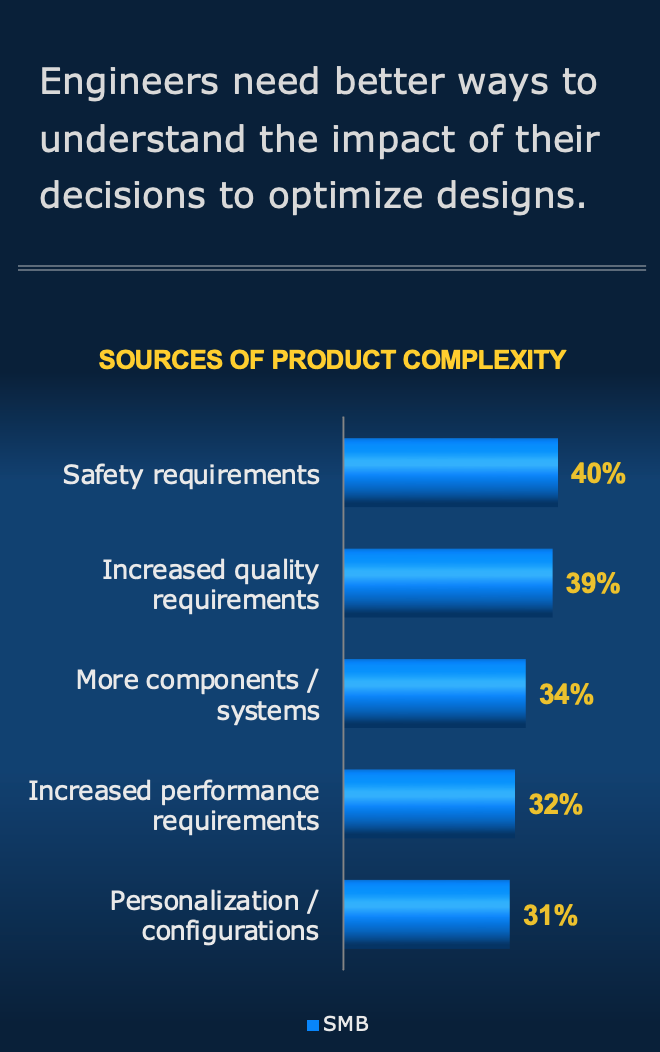

Product Complexity Complicates Engineering Decisions

Significant Product Complexity

While business complexity has created a challenging environment, the products have also become more complex, creating even more difficulties for engineers. The graph shows the top sources of product complexity. Much of this complexity comes from increased requirements.

More Requirements

With increased regulations, engineers have more safety requirements to deal with. As we saw earlier, quality is critical to product success, and this is driving more quality requirements. Customers also expect high performance, which is vital for competitive differentiation. Yet, innovation requirements have increased the number of components and systems, creating more factors to consider and making it even harder for engineers to understand the impact of their decisions. They need better ways to understand this to optimize designs and avoid inadvertently introducing errors. They also need to validate and verify requirements.

Getting this insight as the engineer works on it is the most efficient use time, especially compared to waiting weeks or months for physical test results when the design details are no longer fresh in the engineer's memory. Not to mention, the later it is in the design process, the more a design has solidified, meaning changes will impact far more components. Any error or overlooked impact will result in errors that can increase costs, cause delays, and hurt quality.

More Configurations

Finally, as companies need to appeal to various market and customer needs, engineers must manage multiple product configurations. Each variant must also meet safety, quality, and performance requirements, adding further complexity while increasing the risk of missing the mark on critical product success factors.

Significant Product Complexity

While business complexity has created a challenging environment, the products have also become more complex, creating even more difficulties for engineers. The graph shows the top sources of product complexity. Much of this complexity comes from increased requirements.

More Requirements

With increased regulations, engineers have more safety requirements to deal with. As we saw earlier, quality is critical to product success, and this is driving more quality requirements. Customers also expect high performance, which is vital for competitive differentiation. Yet, innovation requirements have increased the number of components and systems, creating more factors to consider and making it even harder for engineers to understand the impact of their decisions. They need better ways to understand this to optimize designs and avoid inadvertently introducing errors. They also need to validate and verify requirements.

Getting this insight as the engineer works on it is the most efficient use time, especially compared to waiting weeks or months for physical test results when the design details are no longer fresh in the engineer's memory. Not to mention, the later it is in the design process, the more a design has solidified, meaning changes will impact far more components. Any error or overlooked impact will result in errors that can increase costs, cause delays, and hurt quality.

More Configurations

Finally, as companies need to appeal to various market and customer needs, engineers must manage multiple product configurations. Each variant must also meet safety, quality, and performance requirements, adding further complexity while increasing the risk of missing the mark on critical product success factors.

How to Adopt Simulation-Driven Design

Integrated Design and Analysis

Regardless of performance, design engineers agree on what helps them use simulation the most. Integrated simulation and design tools and simulation embedded inside CAD are the commonly identified features. These features make simulation more accessible to design engineers and provide a way to access the functionality without disrupting their workflow. Plus, engineers stay in a familiar environment.

Integrated Test and Simulation

Beyond making simulation easier to access, most design engineers also appreciate when simulation and test are integrated. As discussed previously, this can help reduce test time. At the same time, engineering teams can benefit from access to test results to improve future simulation models to catch problems caught during physical testing.

Integrated Design and Analysis

Regardless of performance, design engineers agree on what helps them use simulation the most. Integrated simulation and design tools and simulation embedded inside CAD are the commonly identified features. These features make simulation more accessible to design engineers and provide a way to access the functionality without disrupting their workflow. Plus, engineers stay in a familiar environment.

Integrated Test and Simulation

Beyond making simulation easier to access, most design engineers also appreciate when simulation and test are integrated. As discussed previously, this can help reduce test time. At the same time, engineering teams can benefit from access to test results to improve future simulation models to catch problems caught during physical testing.

Recommendations

Recommendations and Next Steps Based on industry experience and research for this report, Tech-Clarity offers the following recommendations for SMBs:- Consider the complex business environment in which engineers must work and ensure they have solutions to enable them to develop successful products. To be competitive in today’s global market, it is critical that products are high-quality, yet low cost and still get to market quickly.

- Understand the factors driving product complexity and empower engineers to navigate it with ways to understand the impact of their decisions so that they can optimize their designs. Simulation is the most common tool SMBs use to manage complexity as it can help balance competing criteria such as cost and quality, while guiding decisions so that products will be more competitive.

- Adopt or increase your use of simulation throughout design to support a simulation-driven design approach, starting at the concept phase, and continuing all the way to physical testing. Top Performers are 75% more likely than Others to start using it at the concept phase

- Use a solution that will empower design engineers to use simulation without disrupting their workflow with features such as CAD/CAE integration or embedded inside CAD, simulation and test integration.

How can semiconductor companies establish a foundation to scale and profitably grow?

The semiconductor industry is projected to experience substantial growth over the next five years. How can semiconductor companies position themselves to take advantage of this growth and increase their profits? What challenges should they overcome to scale and grow the business?

Based on a survey of 207 semiconductor and high-tech professionals, this research study examines semiconductor companies' growth strategies. It identifies challenges related to new product introduction (NPI) challenges that hinder their progress. The research reveals best practices for overcoming these challenges and shares recommendations for establishing a foundation for scalable and profitable growth.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

How can semiconductor companies establish a foundation to scale and profitably grow?

The semiconductor industry is projected to experience substantial growth over the next five years. How can semiconductor companies position themselves to take advantage of this growth and increase their profits? What challenges should they overcome to scale and grow the business?

Based on a survey of 207 semiconductor and high-tech professionals, this research study examines semiconductor companies' growth strategies. It identifies challenges related to new product introduction (NPI) challenges that hinder their progress. The research reveals best practices for overcoming these challenges and shares recommendations for establishing a foundation for scalable and profitable growth.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

Table of Contents

- Executive Summary

- Plans for Profitable Growth

- NPI Challenges

- Identifying Top Performers

- Establish a Foundation for Profitable Growth

- 1. Support Digitalization with a Digital Thread

- 2. Focus on Process Efficiency

- 3. Adopt a Product Lifecycle Management (PLM)

- Become More Sustainable

- Recommendations and Next Steps

- About the Research

- Acknowledgments

Executive Summary

Significant Opportunity It is an exciting time for the semiconductor industry as it once again becomes a key enabler for the next evolution of technology and experiences substantial growth. This growth is so significant that many project the global semiconductor market to reach $1 trillion by 2030. In fact, 2024 saw global sales increase a tremendous 19% year-to-year, and double-digit growth is expected to continue. This growth is fueled by progress like the rise of artificial intelligence (AI), investments in electric vehicles, advancements in autonomous driving, connectivity growth in industrial machinery, and an increasing demand for data storage. This presents a tremendous opportunity for semiconductor companies. However, to capitalize on this potential, they must have the right foundation to support profitable growth. Growth Plans Semiconductor companies aim to grow by broadening into new industries, extending their portfolio, and accelerating their time to market. At the same time, since 2020, customers expect more. They now demand higher quality and faster NPI. To successfully achieve this, there are several NPI challenges they must overcome. They must improve change management, understand dependencies, centralize requirements, and enable traceability. To meet these needs, the most successful companies are adopting Product Lifecycle Management (PLM), supporting digitalization, and improving process efficiency. By doing so, they can meet increased demand and achieve greater success. Integrating Design and Manufacturing One major difference between Top Performers and Others is that they are more likely to integrate their design and manufacturing data. This integration allows them to:- Improve project visibility

- Manage risk

- Improve NPI efficiency

Plans for Profitable Growth

Growth Opportunities With the expected growth in the semiconductor industry, semiconductor companies must strategize to determine the best ways to tap into these opportunities and profitably grow. Over the next five years, they plan to grow by broadening into new industries, extending their portfolios, and accelerating their time to market (see graph). Expand Offerings

By venturing into new industries and broadening their portfolios, semiconductor companies can leverage their existing expertise and innovation investments while tailoring offerings for different use cases. For example, AI, electronic vehicles, and autonomous driving all require specialized chips. By adapting their offerings for these various applications, semiconductor companies can unlock new revenue opportunities. Additionally, reworking existing offerings for specific applications reduces development costs for adjacent offerings, thereby boosting profit margins. Moreover, diversification can help mitigate risks associated with fluctuating demand in specific segments, as experienced with mobile phones in the past. However, overseeing the development of various offerings introduces complexity that must be managed, especially to encourage and support reuse.

Expand Offerings

By venturing into new industries and broadening their portfolios, semiconductor companies can leverage their existing expertise and innovation investments while tailoring offerings for different use cases. For example, AI, electronic vehicles, and autonomous driving all require specialized chips. By adapting their offerings for these various applications, semiconductor companies can unlock new revenue opportunities. Additionally, reworking existing offerings for specific applications reduces development costs for adjacent offerings, thereby boosting profit margins. Moreover, diversification can help mitigate risks associated with fluctuating demand in specific segments, as experienced with mobile phones in the past. However, overseeing the development of various offerings introduces complexity that must be managed, especially to encourage and support reuse.

Accelerate Time to Market

The cyclical nature of the semiconductor industry means timing is crucial. Being the first to market allows a company to seize emerging trends and technological advancements ahead of competitors, thus gaining a competitive edge by capturing market share before rivals respond. This strategy also maximizes the revenue potential of new offerings before the next generation emerges. To achieve this goal, companies must find ways to improve process efficiency.

Innovation

Semiconductor companies face many opportunities for innovation, especially to meet the demanding requirements of AI applications. Those that can improve performance and reduce power consumption better than competitors should capture a substantial share of that market segment. Capabilities that foster collaboration and leverage existing expertise should help to generate new ideas and solutions to accelerate innovation.

Accelerate Time to Market

The cyclical nature of the semiconductor industry means timing is crucial. Being the first to market allows a company to seize emerging trends and technological advancements ahead of competitors, thus gaining a competitive edge by capturing market share before rivals respond. This strategy also maximizes the revenue potential of new offerings before the next generation emerges. To achieve this goal, companies must find ways to improve process efficiency.

Innovation

Semiconductor companies face many opportunities for innovation, especially to meet the demanding requirements of AI applications. Those that can improve performance and reduce power consumption better than competitors should capture a substantial share of that market segment. Capabilities that foster collaboration and leverage existing expertise should help to generate new ideas and solutions to accelerate innovation.

Become More Sustainable

Sustainability Strategy

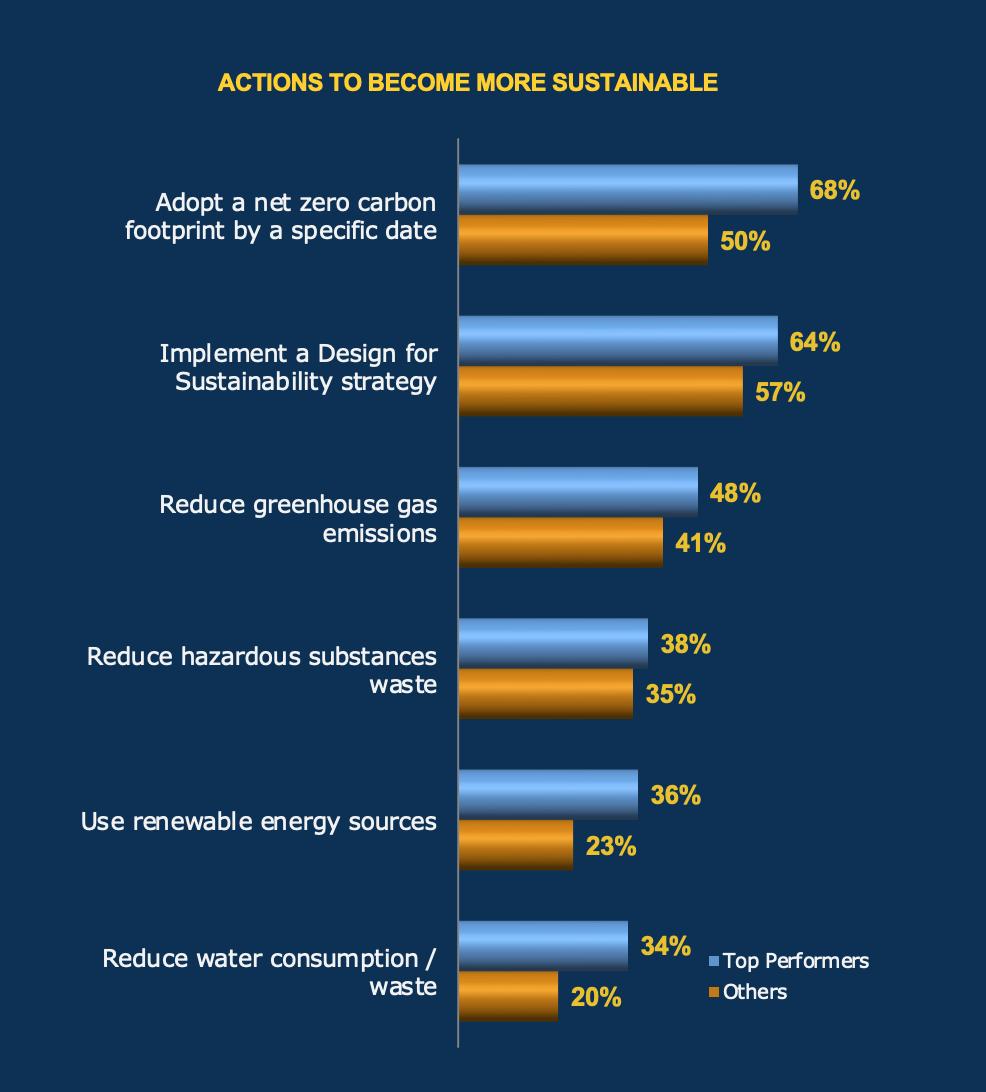

Once semiconductor companies establish a foundation for growth, another important consideration that can provide a competitive advantage is sustainability. While only 15% of companies reported that sustainability is part of their growth plans, an impressive 97% of Top Performing semiconductor companies have implemented a sustainability strategy.

A well-defined sustainability strategy can give a semiconductor company a competitive edge. Many customers increasingly focus on producing energy-efficient, sustainable products with a reduced carbon footprint. Consequently, these customers are more likely to engage with semiconductor companies that prioritize sustainability. The graph shows the top actions taken by Top Performers to become more sustainable

Leverage the PLM Foundation for Sustainability

With the integration of data through a semiconductor PLM platform, companies can also utilize this information to support their sustainability initiatives. By employing digital technologies such as digital twins, simulations, analytics, and BOM roll-ups, companies can evaluate sustainability factors like the carbon footprint from the early stages. This helps understand the impact of different scenarios or options, enabling businesses to identify the best strategies for achieving their sustainability goals. The collaboration tools, supplier management capabilities, and integrated data provided by PLM can assist in capturing the necessary information for these assessments and enabling more informed decision-making.

Sustainability Strategy

Once semiconductor companies establish a foundation for growth, another important consideration that can provide a competitive advantage is sustainability. While only 15% of companies reported that sustainability is part of their growth plans, an impressive 97% of Top Performing semiconductor companies have implemented a sustainability strategy.

A well-defined sustainability strategy can give a semiconductor company a competitive edge. Many customers increasingly focus on producing energy-efficient, sustainable products with a reduced carbon footprint. Consequently, these customers are more likely to engage with semiconductor companies that prioritize sustainability. The graph shows the top actions taken by Top Performers to become more sustainable

Leverage the PLM Foundation for Sustainability

With the integration of data through a semiconductor PLM platform, companies can also utilize this information to support their sustainability initiatives. By employing digital technologies such as digital twins, simulations, analytics, and BOM roll-ups, companies can evaluate sustainability factors like the carbon footprint from the early stages. This helps understand the impact of different scenarios or options, enabling businesses to identify the best strategies for achieving their sustainability goals. The collaboration tools, supplier management capabilities, and integrated data provided by PLM can assist in capturing the necessary information for these assessments and enabling more informed decision-making.

Recommendations and Next Steps

Recommendations and Next Steps Based on industry experience and research for this report, Tech-Clarity offers semiconductor companies the following recommendations to scale and support profitable growth:- Support digitalization with a digital thread. Digitalization provides capabilities to improve efficiency. A digital thread creates the traceability needed to overcome many of the top NPI challenges that slow semiconductor companies down and hurt quality.

- Focus on process efficiency. In the semiconductor industry, time to market is critical to success. Focus on digital workflows to achieve greater levels of efficiency.

- Integrate design and manufacturing data. Integrating data creates a digital thread and traceability, supporting digital processes and streamlining change management.

- Adopt PLM. PLM serves as a platform to integrate design and manufacturing data, create a digital thread, and support digital processes.

- Become more sustainable. While sustainability may not be an important growth strategy, it can offer a competitive advantage, especially with customers focused on reducing their carbon footprint.

*This summary is an abbreviated version of the ebook and does not contain the full content. For the full research, please visit our sponsor, Siemens (registration required).

If you have difficulty obtaining a copy of the research, please contact us.

[post_title] => Three Ways Semiconductor Companies Can Prepare for Profitable Growth

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => semiconductor-growth

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-12 10:26:11

[post_modified_gmt] => 2026-01-12 15:26:11

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23350

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[9] => WP_Post Object

(

[ID] => 23317

[post_author] => 2572

[post_date] => 2026-01-07 09:41:13

[post_date_gmt] => 2026-01-07 14:41:13

[post_content] =>

*This summary is an abbreviated version of the ebook and does not contain the full content. For the full research, please visit our sponsor, Siemens (registration required).

If you have difficulty obtaining a copy of the research, please contact us.

[post_title] => Three Ways Semiconductor Companies Can Prepare for Profitable Growth

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => semiconductor-growth

[to_ping] =>

[pinged] =>

[post_modified] => 2026-01-12 10:26:11

[post_modified_gmt] => 2026-01-12 15:26:11

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=23350

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[9] => WP_Post Object

(

[ID] => 23317

[post_author] => 2572

[post_date] => 2026-01-07 09:41:13

[post_date_gmt] => 2026-01-07 14:41:13

[post_content] =>  How can automotive manufacturers improve engineering productivity?

It's an inspiring time for the automotive industry. Innovations through electrification, automation, and more are revolutionizing the industry like never before. Vehicles continue to be more comfortable, safer, and fuel-efficient, while new service offerings present further opportunities for innovation. All of this relies on the engineering team’s ability to deliver. Unfortunately, engineers regularly lose productivity to non-value-added tasks that not only rob them of their ability to innovate, but also threaten their company’s ability to compete, differentiate, and grow. Imagine the potential of identifying and removing the most common non-value-add activities engineers face and empowering them to focus on better vehicles, components, and systems.

This research examines how engineers spend their time, where they lose productivity, and the impact on the business. It then identifies solutions and approaches to reduce time wasters. Based on a survey of 228 manufacturers across industries, this report focuses on automotive companies and looks at the challenges and opportunities from their perspective.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

This report is based off the research published in The Business Value of Reducing Engineering Time Wasters which takes a look across all industries.

For other industry-specific related research, read our Reducing Engineering Time Wasters reports for:

To received personalized recommendations for how your company could improve engineering productivity, take our 5-minute online assessment.

How can automotive manufacturers improve engineering productivity?

It's an inspiring time for the automotive industry. Innovations through electrification, automation, and more are revolutionizing the industry like never before. Vehicles continue to be more comfortable, safer, and fuel-efficient, while new service offerings present further opportunities for innovation. All of this relies on the engineering team’s ability to deliver. Unfortunately, engineers regularly lose productivity to non-value-added tasks that not only rob them of their ability to innovate, but also threaten their company’s ability to compete, differentiate, and grow. Imagine the potential of identifying and removing the most common non-value-add activities engineers face and empowering them to focus on better vehicles, components, and systems.

This research examines how engineers spend their time, where they lose productivity, and the impact on the business. It then identifies solutions and approaches to reduce time wasters. Based on a survey of 228 manufacturers across industries, this report focuses on automotive companies and looks at the challenges and opportunities from their perspective.

Please enjoy the summary* below. For the full research, please visit our sponsor, Siemens (registration required).

This report is based off the research published in The Business Value of Reducing Engineering Time Wasters which takes a look across all industries.

For other industry-specific related research, read our Reducing Engineering Time Wasters reports for:

To received personalized recommendations for how your company could improve engineering productivity, take our 5-minute online assessment.

Table of Contents

- Executive Summary

- Product Development is Critical to Business Strategies

- The Time Wasters

- Implications of Time Wasters to the Business

- A Solution to Avoid Time Wasters

- Business Value from PLM

- Extending PLM Use Results in Greater Satisfaction

- How Companies Implement PLM

- Additional Values Due to the Cloud

- Conclusions

- Recommendations

- About the Research

- Acknowledgments

Executive Summary

Engineers Impact Business Success

Automotive companies’ ability to deliver exceptional offerings is critical to success. Likewise, their engineers are crucial to ensuring vehicles, components, and systems have what it takes to succeed in the market. Therefore, empowering engineers is key to the successful execution of business strategies.

Too Many Time Wasters

Unfortunately, engineers report spending too much time on non-value-added work with too many interruptions, taking them away from critical innovation work. Furthermore, 97% of surveyed automotive companies say this loss in engineering productivity comes at a significant business cost due to missed deadlines, higher costs, and less innovation. To overcome productivity losses, one approach is to manage product data and processes better and make it accessible to those who need it, when they need it.

Reclaiming Wasted Time

This report identifies major engineering time wasters in the automotive industry. It explores how companies of all sizes reclaim lost time by examining the use and value of PLM (Product Lifecycle Management) solutions to centralize data, manage processes, and collaborate better. PLM users reported fewer changes due to outdated information and errors, significantly reducing non-value-added work and shortening development times. This report also examines how companies select and use PLM solutions, including cloud-based implementations.

Engineers Impact Business Success

Automotive companies’ ability to deliver exceptional offerings is critical to success. Likewise, their engineers are crucial to ensuring vehicles, components, and systems have what it takes to succeed in the market. Therefore, empowering engineers is key to the successful execution of business strategies.

Too Many Time Wasters

Unfortunately, engineers report spending too much time on non-value-added work with too many interruptions, taking them away from critical innovation work. Furthermore, 97% of surveyed automotive companies say this loss in engineering productivity comes at a significant business cost due to missed deadlines, higher costs, and less innovation. To overcome productivity losses, one approach is to manage product data and processes better and make it accessible to those who need it, when they need it.

Reclaiming Wasted Time

This report identifies major engineering time wasters in the automotive industry. It explores how companies of all sizes reclaim lost time by examining the use and value of PLM (Product Lifecycle Management) solutions to centralize data, manage processes, and collaborate better. PLM users reported fewer changes due to outdated information and errors, significantly reducing non-value-added work and shortening development times. This report also examines how companies select and use PLM solutions, including cloud-based implementations.

The Time Wasters

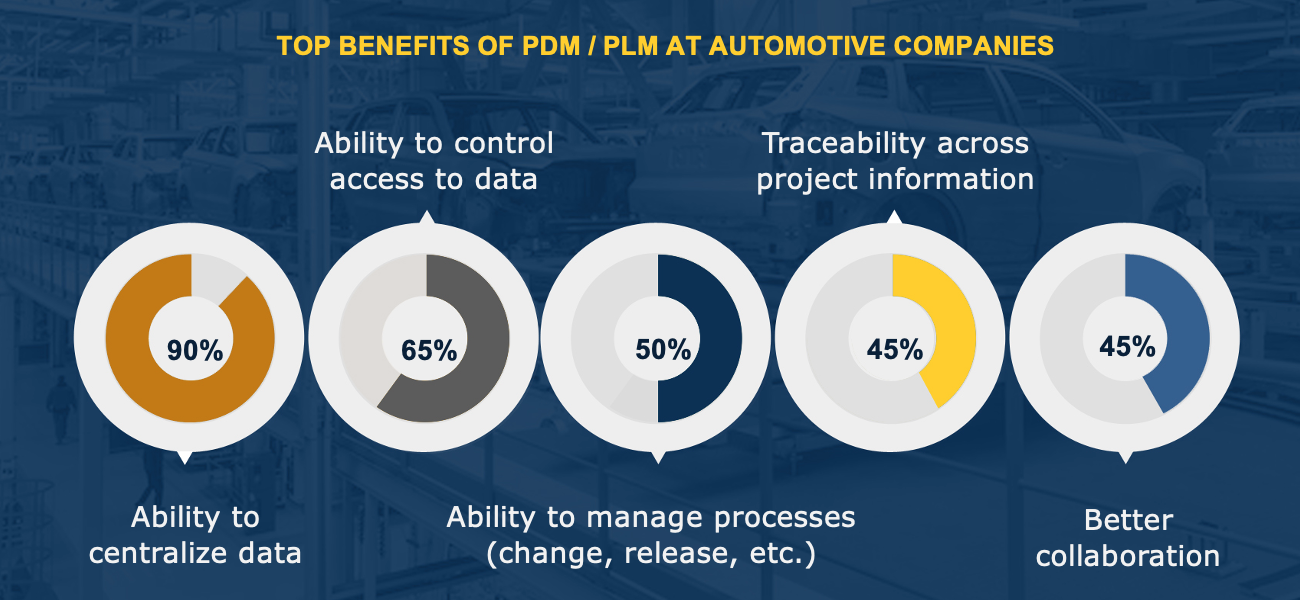

What Slows Engineers Down? The graph identifies the top engineering time wasters automotive companies face. The findings highlight how much engineers waste on non-value-added work. They need better ways to automate tedious tasks so they can focus more energy on adding value. Limited Reuse Vehicles have become increasingly complicated, evolving into complex interconnected systems of mechanical components, electronics, and software. The more engineers can leverage compliant, proven, and tested subsystems and components, the more time they will save. This also reduces the risk of introducing errors and missing requirements. However, the number of components across multiple engineering domains and suppliers, makes it very difficult to find needed data, and searching for it wastes valuable time. Also, platform designs require managing complex configurations which consumes even more time. To avoid these issues, engineers need suitable methods for finding what they need and managing configurations. Time Preparing for Manufacturing Engineers also invest significant time gathering all required data to release to manufacturing. Any data inaccuracies can result in costly scrap, rework, and delays. Further, any changes significantly impact production, especially when multiple facilities are affected. Engineers need ways to quickly gather all necessary data with its dependencies, and automated workflows to manage the release process, especially when relying on third parties such as suppliers or OEMs. Interruptions Constant interruptions to answer questions, share data, and provide updates also slows engineers down. These interruptions break an engineer's train of thought and take them away from other work. Redoing Work Engineers also waste efforts redoing work. They recreate it when they can’t find it or must fix errors due to outdated information. Better methods to centralize data would help get that time back. Poor Collaboration Finally, companies find that poor collaboration also wastes time. This is especially critical for automotive companies given the number of engineering domains involved.A Solution to Avoid Time Wasters

How PLM Reduces Time Wasters We will now focus on how PLM can be a potential solution to reduce engineering time-wasters. Automotive companies that have implemented PLM experience many benefits (see lower graphic). Engineers at automotive companies pointed to centralizing data as a top PLM benefit. Centralizing data makes it easier to find and allows them to effectively manage processes, such as engineering changes and release processes. They can also improve collaboration and traceability across projects. More automated processes and centralized data mean PLM users waste less time searching for data, and data stays up-to-date, so they don't have to recreate work if they can't find it or redo it because they used outdated information. Also, centralized data means others have easier access to what they need, when they need it, so engineers are interrupted less. This is especially critical with the multidomain systems typical in the automotive industry. Engineering Changes On top of this, respondents from automotive companies report that PLM reduces many sources of changes (see graph on right). Engineering changes resulting from these issues squander time, taking them away from innovation efforts that add more value. Avoiding these issues will save engineers significant time.

Conclusions

Reclaiming Lost Time Automotive companies prioritize their future growth and sustained success on winning in the marketplace with better, differentiated offerings. To support this, they can boost their product development capabilities significantly by eliminating time wasters that consume engineers' valuable time. Automotive companies find that PLM can empower their engineers to innovate by significantly reducing engineers' time on non-value-added tasks. As a result, they can enjoy a competitive advantage. In addition, technological advances, such as cloud-based offerings, can reduce implementation time, cost, and difficulty, making PLM more accessible.Recommendations

Next Steps Based on industry experience and research for this report, Tech-Clarity offers the following recommendations to automotive companies:

Based on industry experience and research for this report, Tech-Clarity offers the following recommendations to automotive companies:

- Consider the business impact of engineering time wasters on your company and make investments to minimize them. Empowering engineers to focus more time on value-added work will enable you to get to market faster with better, more differentiated offerings.

- Consider how challenging it can be to find and recruit engineering talent in today’s business climate. Freeing engineers from time-wasting tasks can help take some pressure off your existing staff, improving their work environment and productivity, increasing job satisfaction, and reducing the need to add more staff.

- Look at PLM as a potential solution to reduce engineering time wasters. Automotive companies report that PLM offers benefits such as centralizing data, managing processes, and improving collaboration. This frees engineers from tasks that waste their time so they can focus more on engineering and innovation.

- Use PLM for more than managing data. Those most satisfied with PLM also use it to manage engineering change processes, access control, requirements, and release processes.

- Extend the use of PLM to a broader audience beyond engineering. Those most satisfied with it include management, manufacturing, quality, and sales as users.

- Select a solution that has the flexibility to configure to your processes. An overwhelming 74% who found the implementation easy, identified this as helpful to the implementation.

- Consider a cloud solution. Interestingly, 78% of those who implemented a cloud solution considered the deployment easy and implemented it in half the time required by those using a non-cloud solution.

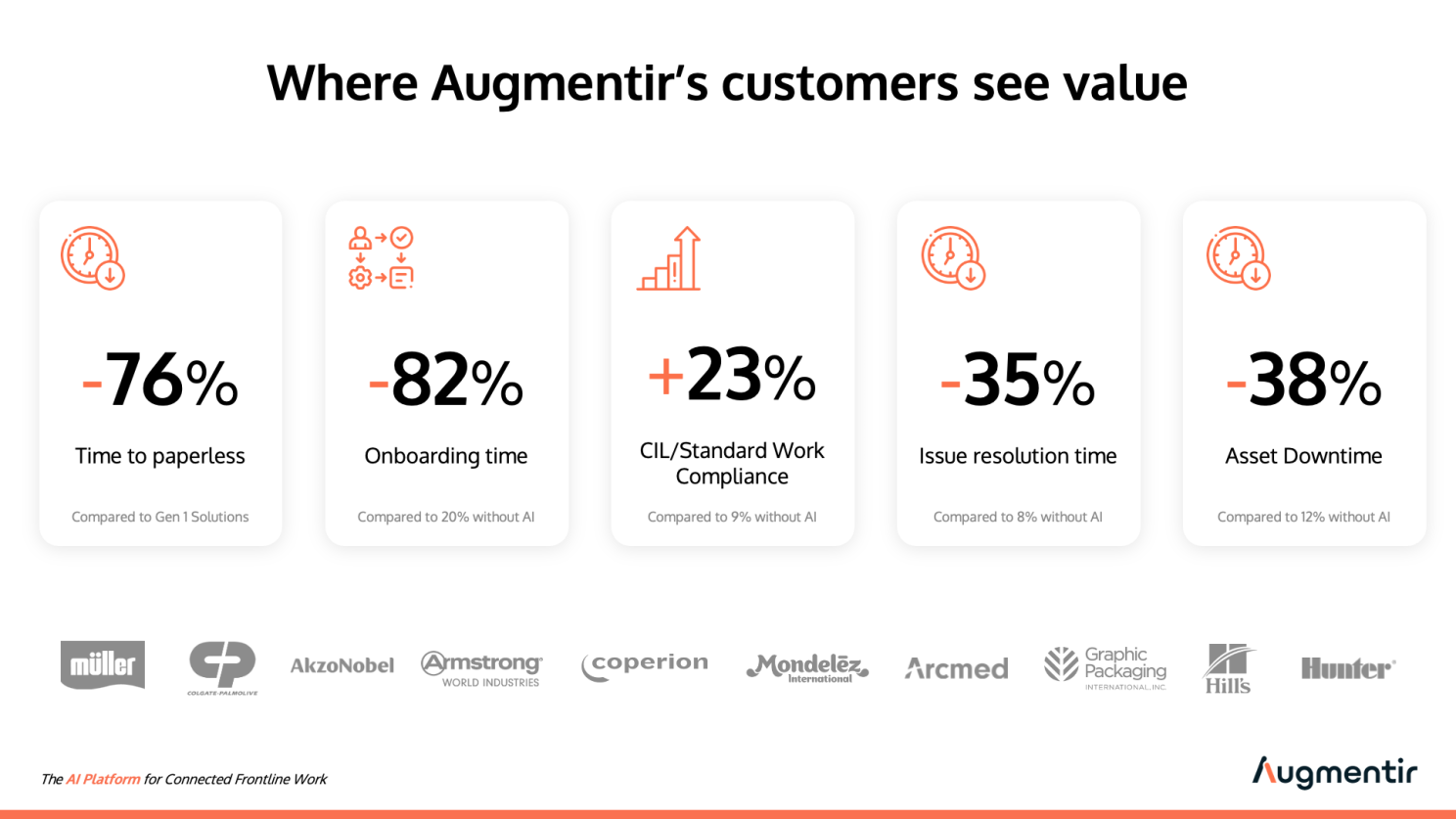

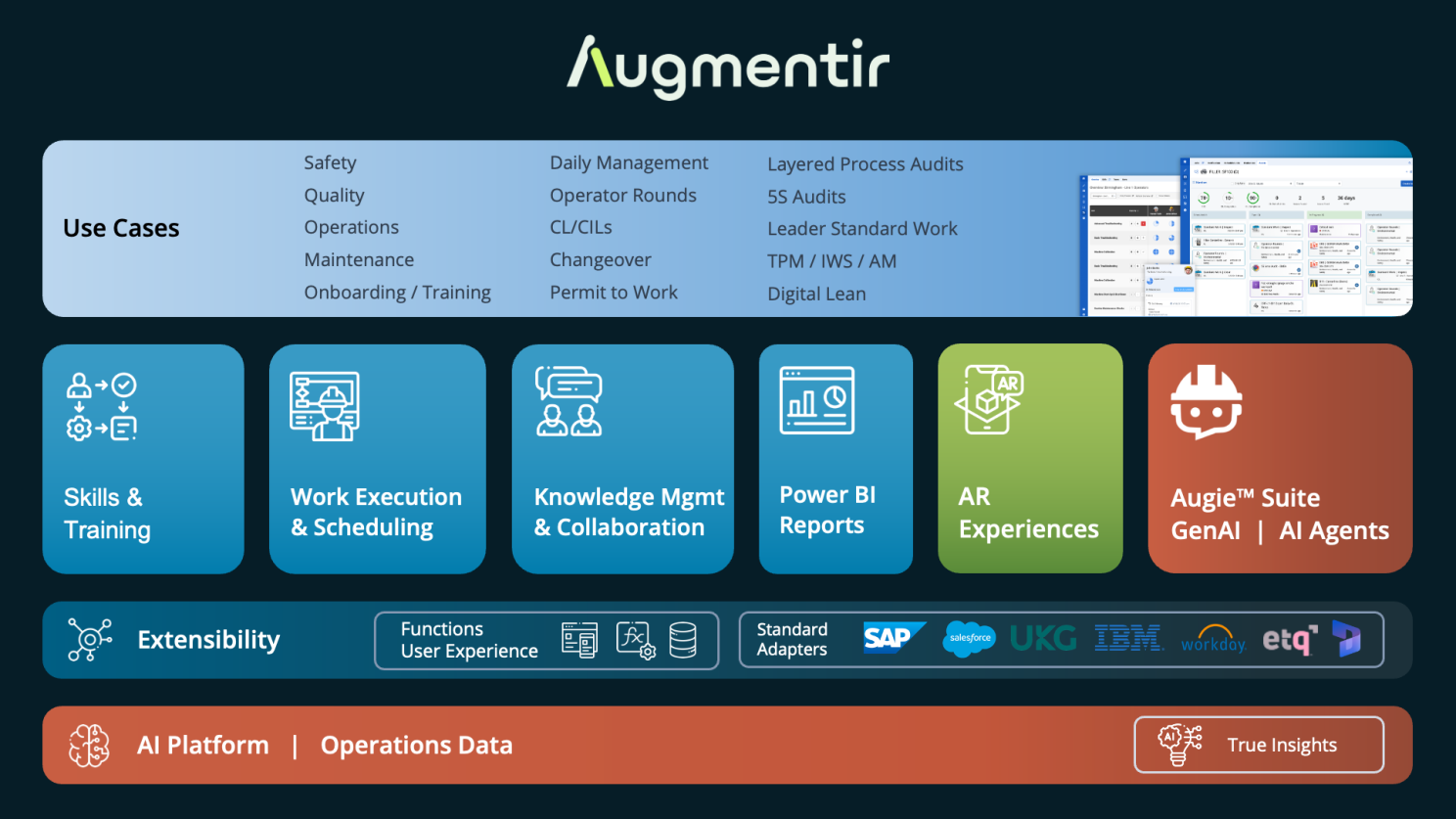

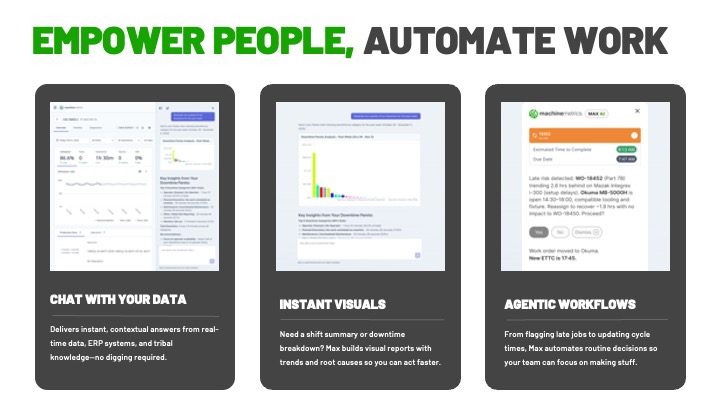

What would add value to a comprehensive, AI-based connected frontline worker (CFW) platform? Augmentir has added more customized and agentic AI, and we see considerable potential benefits. This company launched in 2019 with AR and deep machine learning-based AI, and has most recently added a no-code industrial AI agent studio. This is an addition to their GenAI-based Augie capabilities that span the platform.

What would add value to a comprehensive, AI-based connected frontline worker (CFW) platform? Augmentir has added more customized and agentic AI, and we see considerable potential benefits. This company launched in 2019 with AR and deep machine learning-based AI, and has most recently added a no-code industrial AI agent studio. This is an addition to their GenAI-based Augie capabilities that span the platform.

Two-Way Frontline Data Flows

Augmentir set out to address “the impact of a smaller, less skilled, and less experienced frontline workforce” and is making headway in building out the software and the customer base. The concept is to have a single pane of glass where a frontline worker gets everything they need, in context, and nothing more. The platform integrates with a wide variety of plant and enterprise software for training and daily work.

Augmentir’s platform includes what most CFWs do: content authoring and conversion for instructions, a skills matrix, knowledge management, and sharing. It delivers any needed training based on the user’s profile and previous experience with a particular task in the flow of work. It also includes data visualization and reporting, with Microsoft’s Power BI embedded in the Augmentir platform. The founders also have an augmented reality background, so leveraging that immersive approach is native.