How can manufacturers maximize value from their digital transformation efforts in 2021? In these uncertain times, it matters. There are some basics to leveraging Industry 4.0 trends. Success may be closer to your grasp than you realize. This live webinar has passed, but please click here to watch it free, on-demand. Find out where trends…

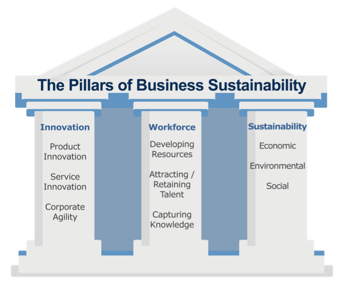

- Agility and flexibility: Can you handle uncertainty and respond as the market changes? This is at the heart of Industry 4.0. It's also crucial to navigating the effects of COVID-19.

- Build from a strong foundation: Will your new technology projects fail? Discover why they are doomed unless you have strong enterprise systems as underpinning.

- Smooth data flows: Do your people always have a clear source of the truth? Why master data management is essential to speed and agility of response.

- New business models: Can your company stay profitable and competitive in 2021? How manufacturers can move toward added-value services, improving sustainability, and new channels to market.

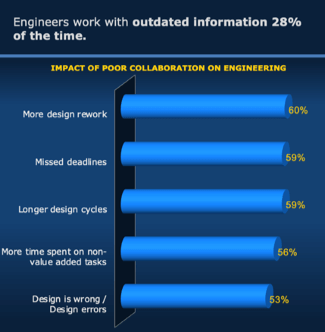

Tech-Clarity’s eBook, What’s the Cost of Poor Collaboration? examines this topic for product development, sharing survey results from 155 manufacturers. Collaboration impacts every part of product development, and products cannot be developed or brought to market without it. While collaboration can be abstract and hard to measure, it's impact can be significant, especially when it is poor. The research reveals how it impacts your product design and development processes. It also identifies six areas of opportunity for collaboration improvements that can boost product profitability for your company.

Please enjoy the summary* below. For the full research, please visit our sponsor, Dassault Systèmes SOLIDWORKS (registration required).

Tech-Clarity’s eBook, What’s the Cost of Poor Collaboration? examines this topic for product development, sharing survey results from 155 manufacturers. Collaboration impacts every part of product development, and products cannot be developed or brought to market without it. While collaboration can be abstract and hard to measure, it's impact can be significant, especially when it is poor. The research reveals how it impacts your product design and development processes. It also identifies six areas of opportunity for collaboration improvements that can boost product profitability for your company.

Please enjoy the summary* below. For the full research, please visit our sponsor, Dassault Systèmes SOLIDWORKS (registration required).

Table of Contents

- Executive Summary

- What's Most Important for Design Team Success

- The Cost of Poor Collaboration on Engineers

- The Cost of Poor Collaboration on the Business

- Why Collaboration is So Critical

- Collaboration Requirements Have Increased

- Identifying Best Practices

- 1. Improve Engineering Efficiency

- 2. Recognize Collaboration Requirements

- 3. Provide Non-CAD Users Visibility to CAD

- 4. Improve Engineering / Manufacturing Collaboration

- 5. Connect Engineers and Simulation Analysts throughout the Design Process

- 6. Support Market Validation with Improved Customer Collaboration

- Recommendations

- About the Research

- Acknowledgments

Executive Summary

Collaboration Impacts Engineering Efficiency Survey results show that engineering efficiency is the top goal for product development success. Effective collaboration is critical for improving efficiency, yet many companies struggle with it, while others don't recognize the underlying connection between the two. While poor collaboration is not a new problem, its cost has never been higher. Today's complex products and

the ecosystems we develop them in have raised collaboration needs so much, 40% of engineering time is now directly impacted by their ability to work together. With this much time affected, poor collaboration can cost companies significantly. While many companies struggle with steep competition, shrinking margins, and uncertain economic times, this is a risk few can afford.

Poor Collaboration has a Business Cost

Unfortunately, poor collaboration is so common, engineers report they work with outdated data 28% of the time. This results in more rework, delays, and errors. These negative business impacts mean lower-quality products, higher costs, missed deadlines, and delays in time to market.

In fact, what has traditionally worked in the past is no longer enough to stay competitive in today's market. An overwhelming 93% of companies report they need to improve collaboration with different groups. On average, engineers say they collaborate with 21 people on simple products and 35 for more complex products. Collaborators include other engineers, manufacturing, suppliers, customers, product managers, and more. On top of all the other design responsibilities, that's a lot of people to manage, work to keep track of, and risk for errors, without helpful solutions in place. No wonder the cost of poor collaboration is so high!

New Opportunities for Solutions

Many companies just live with their collaboration challenges, but as collaboration needs increase, these problems become harder and harder to ignore. As new technologies, such as the cloud and innovation platforms, break down silos and collaboration barriers, companies can benefit from new approaches to solve these challenges. Those who do should gain a competitive advantage.

While poor collaboration is not a new problem, its cost has never been higher. Today's complex products and

the ecosystems we develop them in have raised collaboration needs so much, 40% of engineering time is now directly impacted by their ability to work together. With this much time affected, poor collaboration can cost companies significantly. While many companies struggle with steep competition, shrinking margins, and uncertain economic times, this is a risk few can afford.

Poor Collaboration has a Business Cost

Unfortunately, poor collaboration is so common, engineers report they work with outdated data 28% of the time. This results in more rework, delays, and errors. These negative business impacts mean lower-quality products, higher costs, missed deadlines, and delays in time to market.

In fact, what has traditionally worked in the past is no longer enough to stay competitive in today's market. An overwhelming 93% of companies report they need to improve collaboration with different groups. On average, engineers say they collaborate with 21 people on simple products and 35 for more complex products. Collaborators include other engineers, manufacturing, suppliers, customers, product managers, and more. On top of all the other design responsibilities, that's a lot of people to manage, work to keep track of, and risk for errors, without helpful solutions in place. No wonder the cost of poor collaboration is so high!

New Opportunities for Solutions

Many companies just live with their collaboration challenges, but as collaboration needs increase, these problems become harder and harder to ignore. As new technologies, such as the cloud and innovation platforms, break down silos and collaboration barriers, companies can benefit from new approaches to solve these challenges. Those who do should gain a competitive advantage.

Recommendations

Next Steps Based on industry experience and research for this report, Tech-Clarity offers the following recommendations:- Understand the true cost of poor collaboration on both engineers and the entire company.

- Invest in collaboration improvements to increase engineering efficiency.

- Recognize the significance of collaboration requirements on engineers from the number of people involved, different departments, and processes impacted.

- Do not overlook the importance of engineering collaboration with non-CAD users.

- Ensure excellent collaboration between engineering and manufacturing to overcome knowledge gaps and support seamless hand-offs.

- Support effective collaboration between design engineers and simulation analysts to empower engineers to catch problems and design more competitive products.

- Incorporate customer collaboration into product development processes to support ongoing market validation and reduce the risk around market uncertainty.

- Consider modern technologies, such as cloud and an innovation platform, to support and enable better collaboration processes.

How are companies adopting design and engineering solutions on the cloud?

Tech-Clarity’s Jim Brown got together (virtually) with Siemens Digital Industries Software Senior Marketing Director Paul Brown to share perspectives and examples.

[audio mp3="https://tech-clarity.com/wp-content/uploads/2020/10/Design-and-Engineer-Cloud-Adoption-2020-10-06-NEW.mp3"][/audio]

How are companies adopting design and engineering solutions on the cloud?

Tech-Clarity’s Jim Brown got together (virtually) with Siemens Digital Industries Software Senior Marketing Director Paul Brown to share perspectives and examples.

[audio mp3="https://tech-clarity.com/wp-content/uploads/2020/10/Design-and-Engineer-Cloud-Adoption-2020-10-06-NEW.mp3"][/audio]

You can also see related video interviews including: Engineering in the Cloud Conversation and Designing on the Cloud Discussion with Paul Brown, Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell and Siemens Digital Transformation Progress with Brenda Discher.

Transcript:

Jim: Hi, I'm Jim Brown, President of Tech-Clarity, where we make the business value of technology clear. Today, I'm joined again by Paul Brown, Senior Marketing Director at Siemens Digital Industries Software. Paul's been very generous with his time. We've had a chance on this podcast to discuss design solutions moving to the cloud, things like CAD, but also a broader conversation about engineering software moving to the cloud, including things like visualization, rendering, simulation, and a little bit broader conversation about digital transformation. Now I want to really ask Paul, how do engineers adopt these solutions? How do engineers adopt these solutions? Let's get some clarity.

Paul, welcome, always a pleasure, I appreciate you coming back onto the podcast.

Paul: It's great to be here, Jim.

Jim: Paul, I know that you get a chance to speak with customers, and I know we're probably in more virtual conversations today than we are in maybe face-to-face conversations, but I'd really like to understand from you what customers are asking for in terms of moving design solutions, engineering solutions to the cloud. I have to imagine that there's a range of demand. Our research shows that some companies really favor the cloud and they are looking in a cloud-first mode. On the other hand, we've got companies that say that they have policies that restrict their use of the cloud, whether it's an internal policy, a governmental regulation, or a customer policy. But most companies are really looking for functionality first and then looking for deployment after the fact and just trying to find the solution that really helps them get their job done. What are you hearing your customers ask for when it comes to engineering solutions on the cloud?

Paul: Well, Jim, it's interesting because you say, you see the multiple different camps of opinions when we look at the cloud, but I think the people that are really looking at cloud are really looking at what can this do to add value to my business? There are always going to be, as you said, there are some people that are, for whatever reason, not going to adopt cloud. They're military, they have systems that have air gaps, so using external cloud technologies may not help them, but in many cases, they're looking at what they can do internally into their network to be able to do that. But then there are other customers who are looking and saying, "Okay, well, how do I leverage the cloud to give me benefits and benefits in my business?" What most designers are not prepared to do is give up functionality. So if you say, "Well, you have to use a skinnied-down system," most engineers, both design engineers, simulation engineers, throw up their hands in horror because they get... You guarantee that they would never be prepared to give up any piece of functionality if it means... No matter what the offer is.

Because everyone gets into it, they know and love the functionality, so what we're seeing in many companies is they're looking for an extension, they're looking for ways that cloud type technologies can help their businesses, whether it's better collaboration, whether it's easier access, whether it's... There are niche applications, very, very specific applications that are targeted at a particular function where the person is not using the system all the time, but wants to leverage the tool. So that's really what we're seeing, is this mixture of desktop applications, but with the added value delivered by cloud as being a more, in many ways a more popular solution than just a wholesale, "I'm going to switch off all my desktops and move everyone to the cloud" as a norm. I think you're seeing this transition period.

Jim: Yeah, I think that lines up very nicely, Paul, with what we're seeing, is that companies are telling us that they're not transitioning to the cloud for cloud's sake. They value the benefits of the cloud, but in the end, they need to meet their targets. They've got innovation, quality, product performance, and time targets that they need to meet. When you think about this transition to the cloud, how does Siemens see customers making that transition? How do you envision that, and how are you supporting them through that process?

Paul: Well, I think there is a few important points about the way that we're trying to support them through this process, and that's giving them the access that they want. Importantly, the first thing is, we're not trying to force them down a particular route, so we're happy for them to go their own pace, their own way, and decide how they want to deploy this, and in many cases, it might be that they end up in this hybrid environment, this mixed environment, having software on desktop and software in cloud connecting to get the two together. Importantly, I think the underpinning of that, though, we do a lot of work to make sure that the architectures of our products work across the different environments, whether it's cloud or desktop, so we don't want to find... When we introduce things like Teamcenter X, it works across the entire platform of products. With NX, making sure that anything we do when we're streaming, when we're using cloud type technologies or desktop technologies, that the data is compatible because at the end of the day, the data is what is the customer's intellectual property, and that's where their value is.

We don't want to put them in a situation where they've got to choose, firstly, reductions of functionality, but also things like data translation, moving data around, that is not the type of way we look at these things. We say we want to make it as easy and simple as possible to access the cloud, leverage the benefits of the cloud, but without losing your intellectual property in any way, shape, or form.

Jim: Paul, thanks, and as you're looking forward into the future, do you think that there are certain areas that your customers will look for sooner rather than others? I know I'm asking you a little bit to leverage some of your knowledge of your customers, but also take out the Paul Brown crystal ball and try and understand your view based on your experience. What types of solutions do you see customers adopting first, or is it really just something that's individualized and specialized to each individual customer? Are there trends?

Paul: I think for a lot of the customers that we're talking to, they're looking at ways that they can expand out their usage by leveraging the cloud. They're not just looking at, okay, so I've got CAD on the desktop, got our design on the desktop or engineering on the desktop, and I just want to move it to the cloud because the cloud is cool or the cloud is as far as they're looking at, okay, how can it help expand out my usage? For example, one of the key topics in the mold business for our mold customers is being able to do accurate quoting and being able to estimate such that when they put their quotes out, that they have a high degree of confidence. But that group doing that are not traditional CAD users, but imagine now if by tying together our design tools for the molding, things like our costing tools that are a part of our Teamcenter product, and delivering that over cloud on-demand when people want to use it to do their bids, to do their processes.

That's leveraging the cloud to get a value, and it is expanding out the value of the tools and the digital twin to those customers, versus just a straight swap. And I think that that's what we're seeing, and I'm seeing. They are certain applications, extra applications, more extensions of what they do versus just saying, "Okay, I'm doing core modeling or I'm doing core drafting or core CIM." It's really, how can I get more people involved in the process, because I have got this flexibility and scalability of the cloud.

Jim: Yeah, so not just swapping out what they could do before for a different architecture stack, but really trying to do more and extend value. I think that's a great message. Paul, thank you so much for joining me. I look forward to the days where we can have these conversations in person again, perhaps in a cocktail setting, at a user conference. But for now, I really appreciate the ability to have these conversations virtually. Thank you a lot.

Paul: Absolutely. Thanks, Jim.

[post_title] => Sharing Ideas on Cloud Adoption with Siemens (podcast)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => cloud-adoption-podcast

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-02 15:32:26

[post_modified_gmt] => 2022-12-02 20:32:26

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9885

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[3] => WP_Post Object

(

[ID] => 9918

[post_author] => 2574

[post_date] => 2020-11-02 10:35:18

[post_date_gmt] => 2020-11-02 15:35:18

[post_content] =>

You can also see related video interviews including: Engineering in the Cloud Conversation and Designing on the Cloud Discussion with Paul Brown, Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell and Siemens Digital Transformation Progress with Brenda Discher.

Transcript:

Jim: Hi, I'm Jim Brown, President of Tech-Clarity, where we make the business value of technology clear. Today, I'm joined again by Paul Brown, Senior Marketing Director at Siemens Digital Industries Software. Paul's been very generous with his time. We've had a chance on this podcast to discuss design solutions moving to the cloud, things like CAD, but also a broader conversation about engineering software moving to the cloud, including things like visualization, rendering, simulation, and a little bit broader conversation about digital transformation. Now I want to really ask Paul, how do engineers adopt these solutions? How do engineers adopt these solutions? Let's get some clarity.

Paul, welcome, always a pleasure, I appreciate you coming back onto the podcast.

Paul: It's great to be here, Jim.

Jim: Paul, I know that you get a chance to speak with customers, and I know we're probably in more virtual conversations today than we are in maybe face-to-face conversations, but I'd really like to understand from you what customers are asking for in terms of moving design solutions, engineering solutions to the cloud. I have to imagine that there's a range of demand. Our research shows that some companies really favor the cloud and they are looking in a cloud-first mode. On the other hand, we've got companies that say that they have policies that restrict their use of the cloud, whether it's an internal policy, a governmental regulation, or a customer policy. But most companies are really looking for functionality first and then looking for deployment after the fact and just trying to find the solution that really helps them get their job done. What are you hearing your customers ask for when it comes to engineering solutions on the cloud?

Paul: Well, Jim, it's interesting because you say, you see the multiple different camps of opinions when we look at the cloud, but I think the people that are really looking at cloud are really looking at what can this do to add value to my business? There are always going to be, as you said, there are some people that are, for whatever reason, not going to adopt cloud. They're military, they have systems that have air gaps, so using external cloud technologies may not help them, but in many cases, they're looking at what they can do internally into their network to be able to do that. But then there are other customers who are looking and saying, "Okay, well, how do I leverage the cloud to give me benefits and benefits in my business?" What most designers are not prepared to do is give up functionality. So if you say, "Well, you have to use a skinnied-down system," most engineers, both design engineers, simulation engineers, throw up their hands in horror because they get... You guarantee that they would never be prepared to give up any piece of functionality if it means... No matter what the offer is.

Because everyone gets into it, they know and love the functionality, so what we're seeing in many companies is they're looking for an extension, they're looking for ways that cloud type technologies can help their businesses, whether it's better collaboration, whether it's easier access, whether it's... There are niche applications, very, very specific applications that are targeted at a particular function where the person is not using the system all the time, but wants to leverage the tool. So that's really what we're seeing, is this mixture of desktop applications, but with the added value delivered by cloud as being a more, in many ways a more popular solution than just a wholesale, "I'm going to switch off all my desktops and move everyone to the cloud" as a norm. I think you're seeing this transition period.

Jim: Yeah, I think that lines up very nicely, Paul, with what we're seeing, is that companies are telling us that they're not transitioning to the cloud for cloud's sake. They value the benefits of the cloud, but in the end, they need to meet their targets. They've got innovation, quality, product performance, and time targets that they need to meet. When you think about this transition to the cloud, how does Siemens see customers making that transition? How do you envision that, and how are you supporting them through that process?

Paul: Well, I think there is a few important points about the way that we're trying to support them through this process, and that's giving them the access that they want. Importantly, the first thing is, we're not trying to force them down a particular route, so we're happy for them to go their own pace, their own way, and decide how they want to deploy this, and in many cases, it might be that they end up in this hybrid environment, this mixed environment, having software on desktop and software in cloud connecting to get the two together. Importantly, I think the underpinning of that, though, we do a lot of work to make sure that the architectures of our products work across the different environments, whether it's cloud or desktop, so we don't want to find... When we introduce things like Teamcenter X, it works across the entire platform of products. With NX, making sure that anything we do when we're streaming, when we're using cloud type technologies or desktop technologies, that the data is compatible because at the end of the day, the data is what is the customer's intellectual property, and that's where their value is.

We don't want to put them in a situation where they've got to choose, firstly, reductions of functionality, but also things like data translation, moving data around, that is not the type of way we look at these things. We say we want to make it as easy and simple as possible to access the cloud, leverage the benefits of the cloud, but without losing your intellectual property in any way, shape, or form.

Jim: Paul, thanks, and as you're looking forward into the future, do you think that there are certain areas that your customers will look for sooner rather than others? I know I'm asking you a little bit to leverage some of your knowledge of your customers, but also take out the Paul Brown crystal ball and try and understand your view based on your experience. What types of solutions do you see customers adopting first, or is it really just something that's individualized and specialized to each individual customer? Are there trends?

Paul: I think for a lot of the customers that we're talking to, they're looking at ways that they can expand out their usage by leveraging the cloud. They're not just looking at, okay, so I've got CAD on the desktop, got our design on the desktop or engineering on the desktop, and I just want to move it to the cloud because the cloud is cool or the cloud is as far as they're looking at, okay, how can it help expand out my usage? For example, one of the key topics in the mold business for our mold customers is being able to do accurate quoting and being able to estimate such that when they put their quotes out, that they have a high degree of confidence. But that group doing that are not traditional CAD users, but imagine now if by tying together our design tools for the molding, things like our costing tools that are a part of our Teamcenter product, and delivering that over cloud on-demand when people want to use it to do their bids, to do their processes.

That's leveraging the cloud to get a value, and it is expanding out the value of the tools and the digital twin to those customers, versus just a straight swap. And I think that that's what we're seeing, and I'm seeing. They are certain applications, extra applications, more extensions of what they do versus just saying, "Okay, I'm doing core modeling or I'm doing core drafting or core CIM." It's really, how can I get more people involved in the process, because I have got this flexibility and scalability of the cloud.

Jim: Yeah, so not just swapping out what they could do before for a different architecture stack, but really trying to do more and extend value. I think that's a great message. Paul, thank you so much for joining me. I look forward to the days where we can have these conversations in person again, perhaps in a cocktail setting, at a user conference. But for now, I really appreciate the ability to have these conversations virtually. Thank you a lot.

Paul: Absolutely. Thanks, Jim.

[post_title] => Sharing Ideas on Cloud Adoption with Siemens (podcast)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => cloud-adoption-podcast

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-02 15:32:26

[post_modified_gmt] => 2022-12-02 20:32:26

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9885

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[3] => WP_Post Object

(

[ID] => 9918

[post_author] => 2574

[post_date] => 2020-11-02 10:35:18

[post_date_gmt] => 2020-11-02 15:35:18

[post_content] =>  What happens when automation and plant IT teams get past their differences and work together effectively?

A chance for the company to outperform the competition and make progress on Industry 4.0 projects, based on more coherent manufacturing data management.

In our recent research, Top Performers were more likely to have tightly connected IT and automation or operations technology (OT) organizations. This article provides highlights of the recent research, The Manufacturing Data Challenge: Lessons from Top Performers.

The article touches on investments, integration, and where Top Performers really outshine others in people, process, and technology.

Please visit Automation World to read the article.

Please visit our sponsor, Critical Manufacturing, for the full research (registration required).

[post_title] => The Challenge of Manufacturing Data Management (article)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => manufacturing-data-management-article

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-14 22:25:56

[post_modified_gmt] => 2022-11-15 03:25:56

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9918

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 9830

[post_author] => 2

[post_date] => 2020-10-28 08:00:52

[post_date_gmt] => 2020-10-28 12:00:52

[post_content] =>

What happens when automation and plant IT teams get past their differences and work together effectively?

A chance for the company to outperform the competition and make progress on Industry 4.0 projects, based on more coherent manufacturing data management.

In our recent research, Top Performers were more likely to have tightly connected IT and automation or operations technology (OT) organizations. This article provides highlights of the recent research, The Manufacturing Data Challenge: Lessons from Top Performers.

The article touches on investments, integration, and where Top Performers really outshine others in people, process, and technology.

Please visit Automation World to read the article.

Please visit our sponsor, Critical Manufacturing, for the full research (registration required).

[post_title] => The Challenge of Manufacturing Data Management (article)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => manufacturing-data-management-article

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-14 22:25:56

[post_modified_gmt] => 2022-11-15 03:25:56

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9918

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 9830

[post_author] => 2

[post_date] => 2020-10-28 08:00:52

[post_date_gmt] => 2020-10-28 12:00:52

[post_content] =>  How is the availability of cloud applications for engineering changing the way people work? Tech-Clarity’s Jim Brown got together (virtually) with Siemens Digital Industries Software Senior Marketing Director Paul Brown to share perspectives.

[audio mp3="https://tech-clarity.com/wp-content/uploads/2020/10/Engineering-in-the-Cloud-podcast.mp3"][/audio]

How is the availability of cloud applications for engineering changing the way people work? Tech-Clarity’s Jim Brown got together (virtually) with Siemens Digital Industries Software Senior Marketing Director Paul Brown to share perspectives.

[audio mp3="https://tech-clarity.com/wp-content/uploads/2020/10/Engineering-in-the-Cloud-podcast.mp3"][/audio]

You can also see related video interviews including: Designing on the Cloud Discussion with Paul Brown, Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell and Siemens Digital Transformation Progress with Brenda Discher.

Transcript:

Jim Brown: Hi, I'm Jim Brown, President of Tech-Clarity, where we make the business value of technology clear. Today, I'm joined again by Paul Brown, Senior Marketing Director at Siemens Digital Industries Software. We had a great chance, earlier, to talk about the increased adoption of the cloud in product innovation and engineering. We talked about the changes in the areas of design and supporting digital transformation, and how people are changing the way they work. But how does that apply to the broader topic of engineering in the cloud? Let's get some clarity.

Paul, welcome.

Paul Brown: Hi, Jim. Good to talk to you again.

JIM: Always a pleasure. Paul, last time, we talked about the fact that cloud has values in lots of different areas, in terms of implementation benefits, adoption benefits, operational benefits, and business benefits. There are so many ways that the cloud is changing the world, but we also have seen special areas that it provides even more unique value, in areas of engineering. And some of that has to do with infinite computing versus companies having to maintain banks and banks of servers, and having to continually maintain and replace expensive hardware, for things like generative design that benefit from a tremendous amount of horsepower to drive simulation and iteration, also things like collaboration. In your experience, what types of engineering and engineering applications are best suited for the cloud?

PAUL: Well, it's a good question, Jim, because, as you rightly say, there's a kind of very traditional way of looking at the engineering processes of simulation, and bringing in multi-physics, multiple types of simulation into the process. And for a lot of companies, they're not doing this all the time, they have cyclic needs, depending on where they are in a project, it brings the need for increased power, increased compute power, but also increased flexibility of being able to use that. So, whether it's on, as you mentioned, the traditional way of looking at engineering as simulation, and the computer-aided engineering approaches of structural, thermal, computational fluid dynamics, but we're also seeing it with companies looking at other types of advanced simulations.

Whether it's factory layout, for example. "Can I do a process flow inside of a brand-new build factory to actually analyze the flow of material and optimize that flow of materials?" So going outside of the traditional engineering and into more production engineering type of areas, bringing those types of analysis together. But when you think about it, those are not analysis you're going to be doing every day, they're analysis you'll do a number of times in the project. But the project could span a period of months, it could be six months, it could be a year. And you don't want to have expensive hardware, high-end processing power around doing nothing, so being able to access that level of flexibility and access the software in that way, in a very flexible way, is how you can leverage the cloud. You can actually use the cloud solutions to be able to get access to the software that you need when you need it, and with the power that you need it. It's kind of opening up the power of the entire suite, and it's actually allowing us to expand out the use of the digital twin, with more validation and more optimization and more simulations.

JIM: Great. Thanks Paul. I think those are great examples. Let's drill down a little bit more on scalability from a hardware and a horsepower perspective. Our research and some recent interviews that we've done really show that companies value that power of cloud for scalability. And the ability to access the power that they need for solutions that require a lot of heavy lifting, and those that, as you said earlier, may be something that happens intermittently. You mentioned some simulations of different kinds, I think that's a great example. Are there other kinds of solutions that require a lot of compute power and how does the cloud really help with that?

PAUL: There are. I think, obviously, the traditional one, as I mentioned, everyone looks at the traditional engineering simulations, the structural, the thermal. But there are other areas to leverage the digital twin that we are seeing more people would use. Even things like visualization, it's kind of a form of simulation because often you're looking at a visualization and animation, and to get the really high-end rendering takes a lot of processing power, so you're left with either the need to have expensive graphics engines on-site or you can actually start leveraging the cloud and having your cloud served GPU type access.

So instead of just relying on traditional CPU calculations, actually putting things through graphics processors and having banks of graphic processors that allow you to then farm visualization and dramatically reduce the amount of time it's taking to do things like rendering or animations. And being able to do that on a design model, once again, makes the digital twin richer, because you can start using it, you can start doing things like animating it and showing it's behavior, really bringing that power in, but without having to invest in, say, massive amounts of compute power that do this.

We dealt with one customer and they would spend literally days rendering high quality imagery of their products. Their products were... I wouldn't say... Well, they were complex, but if you looked, they weren't particularly massive products, maybe 10,000 components making up a product. And they wanted to visualize this, because it's in a marketplace which is driven by consumer buying power, so it relies on people who want that desire to own. And being able to generate these high-end renderings was taking them days and being able to shorten that time by farming this out and then maybe overnight on a GPU farm, being able to then get the rendering and then they work with it, navigate it, rotate it, look at it and get a much better, much higher confidence about the quality of the product that they've got. And I think that that's a sort of analysis, that's a sort of use of that scalability without it necessarily being just purely around compute power, it can be graphics power too.

JIM: Thanks, Paul, I appreciate that. And one of the things that we see and we hear from companies as we speak to them is that, like hardware and the need for scalability there, companies have the same need for their software. They've got lumpy demand for their software where they have a variety of different apps, and some of the apps have gotten very specialized. And that maybe they need to access different applications at different times where they may use something intermittently, for example, something like crash analysis that they might use towards the end of a program.

Or somebody might be doing some early analysis on systems engineering very early in the process. And that some of those more specialized tools may be things that would sit on the shelf and not be used, where with the cloud, oftentimes the access to those things is a little bit more flexible as well. And we also see companies that have scalability from programs, for example, they may be running a large program and then roll off of one program and then there may be a gap in time before the next program. So from both a software perspective and a user and business perspective, there's a lot of value in the cloud in terms of that kind of scalability or flexibility as well. Is that something that you're seeing as you're working with your customers?

PAUL: Yeah. Absolutely. I think we're seeing this need, people are now in a model where, as you mentioned, somebody might start a project out and they want to do a lot of analysis using a 1D solution for systems engineering to plan out their systems in the process. And once just the analysis is there and it's driving the design phase, you don't want to have to have that software. Many companies are looking to say, "Okay. Well, I don't need that software all the time." You talk about the complex analysis, and you look at some of these things, like cooling analysis. Well, maybe I only use that one month a year or something in terms of total time. Companies are looking to say, "Okay. Well, how can I get access to the software that I need when I need it?"

And be flexible, be able to say, "Okay. Well, today I've got this problem and it's a cooling problem. Tomorrow I've got a problem and it's a dynamics problem, and I'm trying to do response dynamics, and not be tied in to having to go off and get lots of niche software which I then have to install and manage and maintain, because that's the other thing that people always need to remember is, buying the software is one element. Put your software purchase is great, you then install it, you have to maintain it, you have to make sure that you're upgrading it. There's a constant thing. Well, and companies are now looking for people like ourselves to deliver those solutions where we are maintaining them, where we are offering them the most current versions, where we are making sure that it's all up and running and it's accessible as they need it and when they need it. And for the time that they need it, rather than saying, this is a, "No. You've purchased this and I don't mind how long you use it, but you have to buy it."

So it gives us a much more flexible approach to doing business, and I think that's a key element, is we want to be, as a partner, as flexible as possible for companies as they move into this environment. We're not trying to push people into a particular solution because it suits us. We want people to go at their pace, their own way. We want to make it accessible, usable for our customers, but at the end of the day, our customers have to be in control of the way that they want to run their business.

JIM: Yeah, thank you, Paul. And as you were talking, one of the things that also came to mind for me is companies, oftentimes, as they install software and have to maintain it, they get into that upgrade lag cycle. And we often hear quite a bit of companies talking about the fact that using the cloud when there's new capabilities that become available, they have access to them much faster as opposed to having to wait for an upgrade cycle or going to the user conference, back when we went to user conferences. And hearing about all of the great new functionality but realizing it was going take a year or two before they get it, so just another way we hear people talk about the value of the cloud.

PAUL: No. Absolutely, I think that that whole software lag, I think is something that people often underestimate, because if you're not careful, you get yourself into the business comfort zone, and it's kind of working for us, but the newer and the faster and the improved... Because vendors like ourselves are constantly improving our products, we're constantly improving the security, the performance of our products, and every time somebody puts that lag in the process, the people that get hurt are the end users. So they're the ones that are not seeing the latest, greatest, fastest. So yes, the cloud helps people overcome some of that barrier too.

JIM: And translates to getting programs done better and faster as well. Paul, thank you so much for extending our previous conversation about design in the cloud and really covering a broader aspect of engineering. Always a pleasure, I always learn something when I talk to you, thank you so much.

PAUL: Thanks, Jim, it was great to talk to you.

[post_title] => Engineering in the Cloud Conversation with Siemens (podcast)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => engineering-in-the-cloud-podcast

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-02 15:32:51

[post_modified_gmt] => 2022-12-02 20:32:51

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9830

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[5] => WP_Post Object

(

[ID] => 9858

[post_author] => 2

[post_date] => 2020-10-14 20:50:40

[post_date_gmt] => 2020-10-15 00:50:40

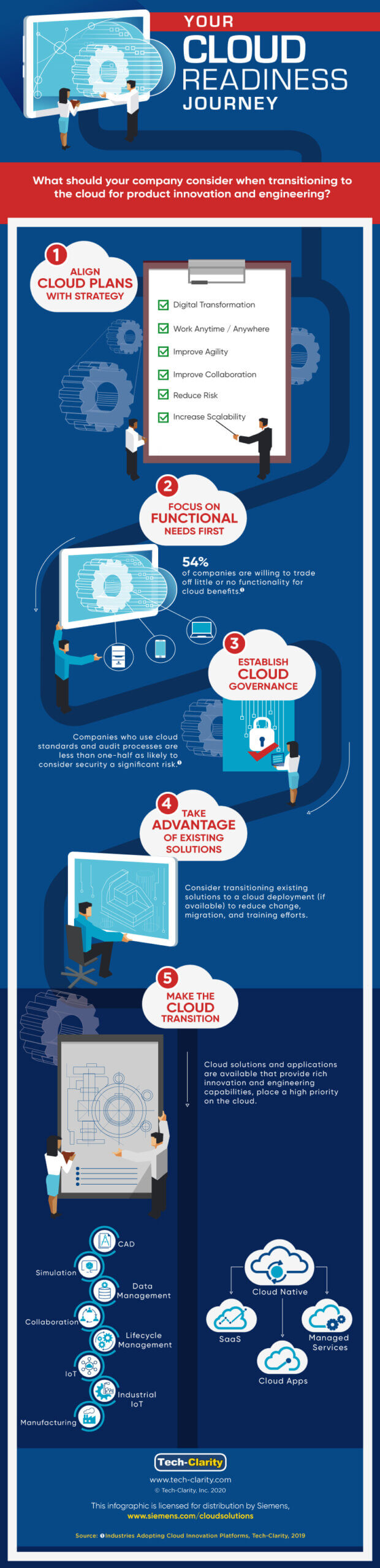

[post_content] => What should your company consider when transitioning to the cloud for innovation and engineering? Our new infographic identifies key considerations ranging from strategy through adoption.

See the infographics for some important factors related to strategy, functionality, governance, existing solutions, and your transition.

You can also learn more about cloud solutions from Siemens Digital Industries Software, our sponsor or view our video series sharing insights from our research and interviews including: Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell, and Siemens Digital Transformation Progress with Brenda Discher.

You can also see related video interviews including: Designing on the Cloud Discussion with Paul Brown, Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell and Siemens Digital Transformation Progress with Brenda Discher.

Transcript:

Jim Brown: Hi, I'm Jim Brown, President of Tech-Clarity, where we make the business value of technology clear. Today, I'm joined again by Paul Brown, Senior Marketing Director at Siemens Digital Industries Software. We had a great chance, earlier, to talk about the increased adoption of the cloud in product innovation and engineering. We talked about the changes in the areas of design and supporting digital transformation, and how people are changing the way they work. But how does that apply to the broader topic of engineering in the cloud? Let's get some clarity.

Paul, welcome.

Paul Brown: Hi, Jim. Good to talk to you again.

JIM: Always a pleasure. Paul, last time, we talked about the fact that cloud has values in lots of different areas, in terms of implementation benefits, adoption benefits, operational benefits, and business benefits. There are so many ways that the cloud is changing the world, but we also have seen special areas that it provides even more unique value, in areas of engineering. And some of that has to do with infinite computing versus companies having to maintain banks and banks of servers, and having to continually maintain and replace expensive hardware, for things like generative design that benefit from a tremendous amount of horsepower to drive simulation and iteration, also things like collaboration. In your experience, what types of engineering and engineering applications are best suited for the cloud?

PAUL: Well, it's a good question, Jim, because, as you rightly say, there's a kind of very traditional way of looking at the engineering processes of simulation, and bringing in multi-physics, multiple types of simulation into the process. And for a lot of companies, they're not doing this all the time, they have cyclic needs, depending on where they are in a project, it brings the need for increased power, increased compute power, but also increased flexibility of being able to use that. So, whether it's on, as you mentioned, the traditional way of looking at engineering as simulation, and the computer-aided engineering approaches of structural, thermal, computational fluid dynamics, but we're also seeing it with companies looking at other types of advanced simulations.

Whether it's factory layout, for example. "Can I do a process flow inside of a brand-new build factory to actually analyze the flow of material and optimize that flow of materials?" So going outside of the traditional engineering and into more production engineering type of areas, bringing those types of analysis together. But when you think about it, those are not analysis you're going to be doing every day, they're analysis you'll do a number of times in the project. But the project could span a period of months, it could be six months, it could be a year. And you don't want to have expensive hardware, high-end processing power around doing nothing, so being able to access that level of flexibility and access the software in that way, in a very flexible way, is how you can leverage the cloud. You can actually use the cloud solutions to be able to get access to the software that you need when you need it, and with the power that you need it. It's kind of opening up the power of the entire suite, and it's actually allowing us to expand out the use of the digital twin, with more validation and more optimization and more simulations.

JIM: Great. Thanks Paul. I think those are great examples. Let's drill down a little bit more on scalability from a hardware and a horsepower perspective. Our research and some recent interviews that we've done really show that companies value that power of cloud for scalability. And the ability to access the power that they need for solutions that require a lot of heavy lifting, and those that, as you said earlier, may be something that happens intermittently. You mentioned some simulations of different kinds, I think that's a great example. Are there other kinds of solutions that require a lot of compute power and how does the cloud really help with that?

PAUL: There are. I think, obviously, the traditional one, as I mentioned, everyone looks at the traditional engineering simulations, the structural, the thermal. But there are other areas to leverage the digital twin that we are seeing more people would use. Even things like visualization, it's kind of a form of simulation because often you're looking at a visualization and animation, and to get the really high-end rendering takes a lot of processing power, so you're left with either the need to have expensive graphics engines on-site or you can actually start leveraging the cloud and having your cloud served GPU type access.

So instead of just relying on traditional CPU calculations, actually putting things through graphics processors and having banks of graphic processors that allow you to then farm visualization and dramatically reduce the amount of time it's taking to do things like rendering or animations. And being able to do that on a design model, once again, makes the digital twin richer, because you can start using it, you can start doing things like animating it and showing it's behavior, really bringing that power in, but without having to invest in, say, massive amounts of compute power that do this.

We dealt with one customer and they would spend literally days rendering high quality imagery of their products. Their products were... I wouldn't say... Well, they were complex, but if you looked, they weren't particularly massive products, maybe 10,000 components making up a product. And they wanted to visualize this, because it's in a marketplace which is driven by consumer buying power, so it relies on people who want that desire to own. And being able to generate these high-end renderings was taking them days and being able to shorten that time by farming this out and then maybe overnight on a GPU farm, being able to then get the rendering and then they work with it, navigate it, rotate it, look at it and get a much better, much higher confidence about the quality of the product that they've got. And I think that that's a sort of analysis, that's a sort of use of that scalability without it necessarily being just purely around compute power, it can be graphics power too.

JIM: Thanks, Paul, I appreciate that. And one of the things that we see and we hear from companies as we speak to them is that, like hardware and the need for scalability there, companies have the same need for their software. They've got lumpy demand for their software where they have a variety of different apps, and some of the apps have gotten very specialized. And that maybe they need to access different applications at different times where they may use something intermittently, for example, something like crash analysis that they might use towards the end of a program.

Or somebody might be doing some early analysis on systems engineering very early in the process. And that some of those more specialized tools may be things that would sit on the shelf and not be used, where with the cloud, oftentimes the access to those things is a little bit more flexible as well. And we also see companies that have scalability from programs, for example, they may be running a large program and then roll off of one program and then there may be a gap in time before the next program. So from both a software perspective and a user and business perspective, there's a lot of value in the cloud in terms of that kind of scalability or flexibility as well. Is that something that you're seeing as you're working with your customers?

PAUL: Yeah. Absolutely. I think we're seeing this need, people are now in a model where, as you mentioned, somebody might start a project out and they want to do a lot of analysis using a 1D solution for systems engineering to plan out their systems in the process. And once just the analysis is there and it's driving the design phase, you don't want to have to have that software. Many companies are looking to say, "Okay. Well, I don't need that software all the time." You talk about the complex analysis, and you look at some of these things, like cooling analysis. Well, maybe I only use that one month a year or something in terms of total time. Companies are looking to say, "Okay. Well, how can I get access to the software that I need when I need it?"

And be flexible, be able to say, "Okay. Well, today I've got this problem and it's a cooling problem. Tomorrow I've got a problem and it's a dynamics problem, and I'm trying to do response dynamics, and not be tied in to having to go off and get lots of niche software which I then have to install and manage and maintain, because that's the other thing that people always need to remember is, buying the software is one element. Put your software purchase is great, you then install it, you have to maintain it, you have to make sure that you're upgrading it. There's a constant thing. Well, and companies are now looking for people like ourselves to deliver those solutions where we are maintaining them, where we are offering them the most current versions, where we are making sure that it's all up and running and it's accessible as they need it and when they need it. And for the time that they need it, rather than saying, this is a, "No. You've purchased this and I don't mind how long you use it, but you have to buy it."

So it gives us a much more flexible approach to doing business, and I think that's a key element, is we want to be, as a partner, as flexible as possible for companies as they move into this environment. We're not trying to push people into a particular solution because it suits us. We want people to go at their pace, their own way. We want to make it accessible, usable for our customers, but at the end of the day, our customers have to be in control of the way that they want to run their business.

JIM: Yeah, thank you, Paul. And as you were talking, one of the things that also came to mind for me is companies, oftentimes, as they install software and have to maintain it, they get into that upgrade lag cycle. And we often hear quite a bit of companies talking about the fact that using the cloud when there's new capabilities that become available, they have access to them much faster as opposed to having to wait for an upgrade cycle or going to the user conference, back when we went to user conferences. And hearing about all of the great new functionality but realizing it was going take a year or two before they get it, so just another way we hear people talk about the value of the cloud.

PAUL: No. Absolutely, I think that that whole software lag, I think is something that people often underestimate, because if you're not careful, you get yourself into the business comfort zone, and it's kind of working for us, but the newer and the faster and the improved... Because vendors like ourselves are constantly improving our products, we're constantly improving the security, the performance of our products, and every time somebody puts that lag in the process, the people that get hurt are the end users. So they're the ones that are not seeing the latest, greatest, fastest. So yes, the cloud helps people overcome some of that barrier too.

JIM: And translates to getting programs done better and faster as well. Paul, thank you so much for extending our previous conversation about design in the cloud and really covering a broader aspect of engineering. Always a pleasure, I always learn something when I talk to you, thank you so much.

PAUL: Thanks, Jim, it was great to talk to you.

[post_title] => Engineering in the Cloud Conversation with Siemens (podcast)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => engineering-in-the-cloud-podcast

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-02 15:32:51

[post_modified_gmt] => 2022-12-02 20:32:51

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9830

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[5] => WP_Post Object

(

[ID] => 9858

[post_author] => 2

[post_date] => 2020-10-14 20:50:40

[post_date_gmt] => 2020-10-15 00:50:40

[post_content] => What should your company consider when transitioning to the cloud for innovation and engineering? Our new infographic identifies key considerations ranging from strategy through adoption.

See the infographics for some important factors related to strategy, functionality, governance, existing solutions, and your transition.

You can also learn more about cloud solutions from Siemens Digital Industries Software, our sponsor or view our video series sharing insights from our research and interviews including: Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell, and Siemens Digital Transformation Progress with Brenda Discher.

[post_title] => Cloud Readiness (infographic)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => cloud-readiness-infographic

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-14 22:26:09

[post_modified_gmt] => 2022-11-15 03:26:09

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9858

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[6] => WP_Post Object

(

[ID] => 9818

[post_author] => 2574

[post_date] => 2020-10-08 12:50:19

[post_date_gmt] => 2020-10-08 16:50:19

[post_content] =>

[post_title] => Cloud Readiness (infographic)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => cloud-readiness-infographic

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-14 22:26:09

[post_modified_gmt] => 2022-11-15 03:26:09

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9858

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[6] => WP_Post Object

(

[ID] => 9818

[post_author] => 2574

[post_date] => 2020-10-08 12:50:19

[post_date_gmt] => 2020-10-08 16:50:19

[post_content] =>  What do manufacturers need to do to succeed and get results from their Industry 4.0 efforts?

In this webcast, Julie Fraser revealed a few significant findings of research of over 300 companies on the topic of manufacturing data management. It’s a multi-faceted challenge in which people, processes, and technology all matter.

This webcast explains the new Tech-Clarity research report’s findings, The Manufacturing Data Challenge: Lessons from Top Performers. Attend to learn what Top Performers are doing differently than others to improve dramatically on both operational and business key performance indicators (KPIs).

Register now to hear about this ground-breaking research, sponsored by Critical Manufacturing (registration required).

[post_title] => Meeting the Manufacturing Data Management Challenge (webcast)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => manufacturing-data-management-webcast

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-14 22:27:02

[post_modified_gmt] => 2022-11-15 03:27:02

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9818

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[7] => WP_Post Object

(

[ID] => 9673

[post_author] => 2574

[post_date] => 2020-10-02 09:39:54

[post_date_gmt] => 2020-10-02 13:39:54

[post_content] =>

What do manufacturers need to do to succeed and get results from their Industry 4.0 efforts?

In this webcast, Julie Fraser revealed a few significant findings of research of over 300 companies on the topic of manufacturing data management. It’s a multi-faceted challenge in which people, processes, and technology all matter.

This webcast explains the new Tech-Clarity research report’s findings, The Manufacturing Data Challenge: Lessons from Top Performers. Attend to learn what Top Performers are doing differently than others to improve dramatically on both operational and business key performance indicators (KPIs).

Register now to hear about this ground-breaking research, sponsored by Critical Manufacturing (registration required).

[post_title] => Meeting the Manufacturing Data Management Challenge (webcast)

[post_excerpt] =>

[post_status] => publish

[comment_status] => open

[ping_status] => open

[post_password] =>

[post_name] => manufacturing-data-management-webcast

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-14 22:27:02

[post_modified_gmt] => 2022-11-15 03:27:02

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://tech-clarity.com/?p=9818

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[7] => WP_Post Object

(

[ID] => 9673

[post_author] => 2574

[post_date] => 2020-10-02 09:39:54

[post_date_gmt] => 2020-10-02 13:39:54

[post_content] =>  How do companies make progress toward Industry 4.0? Based on our research, those who invest in people, processes, and technology for manufacturing data management have made more strides in Industry 4.0. Manufacturing Data Management: Lessons from Top Performers explores the many challenges of bringing together all the data production facilities need.

Please enjoy the summary* below. For the full research, please visit our sponsor Critical Manufacturing (registration required).

How do companies make progress toward Industry 4.0? Based on our research, those who invest in people, processes, and technology for manufacturing data management have made more strides in Industry 4.0. Manufacturing Data Management: Lessons from Top Performers explores the many challenges of bringing together all the data production facilities need.

Please enjoy the summary* below. For the full research, please visit our sponsor Critical Manufacturing (registration required).

Table of Contents

- Vision for Business Breakthroughs

- Keys to Industry 4.0 Success

- Manufacturing Data Management Activity

- Vertical Integration

- Challenges in the Current State

- Defining Plant Operations Success

- Top Performers Make Progress

- Organizational Issues

- Staffing for Manufacturing Data Programs

- Viewpoints on Skills

- Manufacturing Data Management Initiatives

- What Does It Take?

- Technology: Feeding Success?

- Manufacturing Data Approaches

- Business Impact

- Conclusions

- Recommendations

- About the Research

- Acknowledgments

Executive Overview

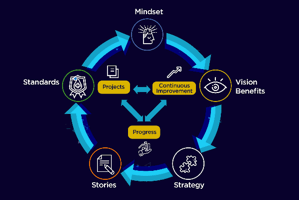

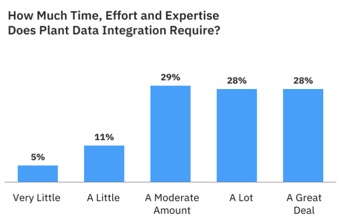

Prioritizing Manufacturing Data Management What have manufacturers been struggling with for years that Industry 4.0 insists they solve now? Manufacturing data management. Combining data from information technology (IT) and operations technology (OT) is essential to analysis and insights. Thus, coherent and consistent plant data is a foundation for achieving the agility and business value companies want. Yet it is anything but straightforward. And it’s not the only thing companies need to meet the challenge of manufacturing data. Research Reveals This research aims to learn about current challenges, strategies, and programs for manufacturing data management. Over 300 responded, from manufacturers in various industry segments and of all sizes, working with data from plants in every corner of the world. We uncovered a significant and nearly universal outstanding need: better ways to integrate IT and OT data. We also discovered that there are paths that appear to lead to greater success for those who travel them most aggressively.

Top Performers have made mindset, organization, and staffing changes. They are also far more likely to be using commercial software solutions and adopting modern approaches to accelerate their ability to manage manufacturing data effectively. As a result, a larger percentage of these Top Performers have already made dramatic improvements in business performance. They are in a position to make more gains.

This research aims to learn about current challenges, strategies, and programs for manufacturing data management. Over 300 responded, from manufacturers in various industry segments and of all sizes, working with data from plants in every corner of the world. We uncovered a significant and nearly universal outstanding need: better ways to integrate IT and OT data. We also discovered that there are paths that appear to lead to greater success for those who travel them most aggressively.

Top Performers have made mindset, organization, and staffing changes. They are also far more likely to be using commercial software solutions and adopting modern approaches to accelerate their ability to manage manufacturing data effectively. As a result, a larger percentage of these Top Performers have already made dramatic improvements in business performance. They are in a position to make more gains.

Vision for Business Breakthroughs

The Status Quo is Risky Many companies are now pursuing digital transformation for a new and dramatically different future. With tremendous amounts of data at every level, but especially in production plants, manufacturers know they must do a better job using that data for business decisions. And manufacturing data poses special issues. Most Are on a Path to Industry 4.0 This vision of manufacturing transformation based on digital approaches is often called Industry 4.0. Most manufacturers in every industry and size range indicate that they have multiple Industry 4.0 projects underway. Traditional and Innovative Goals The goals are for agility and performance improvements on business-critical key performance indicators (KPIs). Some companies are also running a data-driven business to make more revenue from services or find other ways to add value.Recommendations for Manufacturing Data Management

The Path Forward Manufacturers must take action to compete with or stay a Top Performer. Formulating a clear strategy with business benefits for Industry 4.0 is a foundation. We recommend that manufacturers follow the lead of Top Performers:- Prioritize manufacturing data management and invest in both the staffing and the programs to succeed.

- Adopt proven commercial technologies such as MES, PLM, and APS where possible first. They will free up precious time and resources and provide a solid foundation for advanced approaches and analytics.

- Structure a program with projects that feed business needs, then proceed logically, in order of the process. For example, ensure data collection and enrichment are in place before investing in analytics projects.

- Create an environment where collaboration among disciplines feels natural, and the shared vision is more compelling than the inherent differences.

Even for Top Performers, challenges remain. These include data and systems integration, putting IT and OT data into a common context, agreeing on "sources of truth," and identifying data owners.

Note also that this is early days for coherent manufacturing data management. Yes, several times as many of the Top Performers have a program, staff members, capabilities, or dramatic gains on KPIs. Yet they are still only a minority.

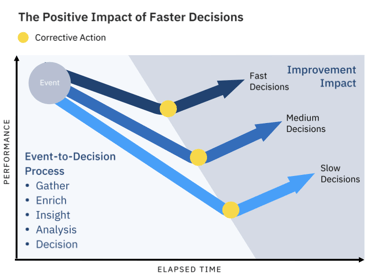

There is more to do for every manufacturer. Faster decisions have always made a difference. However, doing things as we've done them may no longer suffice.

Seek New Approaches to Manufacturing Data Management

So, beyond doing what has been possible, we also encourage companies to seek new approaches. Solution providers are advancing their offerings. Some have integrated more functionality into plant systems. New offerings are becoming available to support manufacturing data management now and in the near future.

Be ready to explore new approaches. Validate their fit and ability to help meet your manufacturing data management challenges. Leverage both new and existing technologies and approaches to progress toward your Industry 4.0 vision.

Even for Top Performers, challenges remain. These include data and systems integration, putting IT and OT data into a common context, agreeing on "sources of truth," and identifying data owners.

Note also that this is early days for coherent manufacturing data management. Yes, several times as many of the Top Performers have a program, staff members, capabilities, or dramatic gains on KPIs. Yet they are still only a minority.

There is more to do for every manufacturer. Faster decisions have always made a difference. However, doing things as we've done them may no longer suffice.

Seek New Approaches to Manufacturing Data Management

So, beyond doing what has been possible, we also encourage companies to seek new approaches. Solution providers are advancing their offerings. Some have integrated more functionality into plant systems. New offerings are becoming available to support manufacturing data management now and in the near future.

Be ready to explore new approaches. Validate their fit and ability to help meet your manufacturing data management challenges. Leverage both new and existing technologies and approaches to progress toward your Industry 4.0 vision.

How is the cloud playing a role in engineers' design processes?

Tech-Clarity’s Jim Brown got together (virtually) with Siemens Digital Industries Software Senior Marketing Director Paul Brown to share perspectives and examples.

[audio mp3="https://tech-clarity.com/wp-content/uploads/2020/09/Tech-Clarity-Cloud-Design-Podcast-2020-09-22.mp3"][/audio]

How is the cloud playing a role in engineers' design processes?

Tech-Clarity’s Jim Brown got together (virtually) with Siemens Digital Industries Software Senior Marketing Director Paul Brown to share perspectives and examples.

[audio mp3="https://tech-clarity.com/wp-content/uploads/2020/09/Tech-Clarity-Cloud-Design-Podcast-2020-09-22.mp3"][/audio]

You can also see related video interviews including: Digital Transformation Progress with Bob Jones, Cloud Progress Report with Bill Boswell, and Siemens Digital Transformation Progress with Brenda Discher.

Transcript:

JIM: Hi, I'm Jim Brown, President of Tech-Clarity, where we make the business value of technology clear. Today, I'm joined by Paul Brown, a long-time industry leader and Senior Marketing Director at Siemens Digital Industries Software. We're going to talk to Paul about design engineering and how the cloud is really playing a big role there. Let's get some clarity.

JIM: Paul, thanks very much for joining me today.

PAUL: Yeah. Thanks, Jim.

JIM: So we've seen increased interest in the cloud in lots of different kinds of solutions, everything from probably email being run on the cloud for a long time, and ERP and others, but we're starting to see a lot of increased interest in design tools on the cloud and understanding how the process of design and engineering can evolve to leverage capabilities of the cloud. So there are obviously a lot of generic benefits of lower barriers to entry for a solution, whether it be cost or hardware, some lower risk and operational benefits around scalability of users and things along those needs, but we've also noticed that there are some really unique benefits for some engineering solutions, and maybe those come from enhanced collaboration or reach, but they may also come from increased scalability, access to "infinite computing power on demand." When you think about what's happening in design and how the cloud may be changing things, what do you think are the most important things for companies to know?

PAUL: Yeah, it's an interesting point, Jim. And I think we're definitely seeing a lot more interest in cloud-based solutions, but I will say, maybe this is a little bit controversial as a viewpoint, but at the moment, we're seeing a lot of interest, adoption is a bit more steady. I think that there's a lot more kind of people kind of, first of all, looking at what this cloud is going to do for them, so what that's really doing is it's actually getting a number of companies into this area where they've got a level of desktop application and they're starting to use cloud solutions combined together, so you end up with this kind of mixed environment. And really the important thing, and one thing I will say is, that's not a choice that we make or... That is a company choice that is down for the companies as they go forward.

PAUL: We can't, as vendors, force people to one or other approach just because it suits us. Okay, and we really have to look at letting customers decide and work at their own pace and their own way of getting forward in these types of technologies and use what's best for them. And that's always been one of the strategies here at Siemens, is that we've been looking at letting people work this way through and adjust, so the important thing is really is flexibility and being able to access the tools that they need to do their job as they need them and when they need them. I think when you start looking at why people, why the cloud is becoming more interesting, I think design really is, and product development is really a collaborative exercise. There are very few products that we see that are designed by a single person right the way through from start to finish, and so it relies on communicating with other people, sharing design work, and so one of the key elements that we're seeing is people are looking at leveraging the cloud to communicate between groups, to be able to make better design decisions, to share information.

PAUL: An example for you here, about two years ago, we introduced a product called NX Virtual Reality. So NX Virtual Reality first came out, it was great. You're inside your NX session, put on a headset, controllers, and you're immersed inside the product, you're one-to-one scale. We showed it to people. They loved it. I mean, people looked, "Yeah, well, it's... Yeah, it's great." But after a while, they kind of, their response starts coming as like, "Well, yeah, it's good, it gives me some benefits, but you know, yeah, it's okay, but... " There's always a but that comes on. Last year, what we did is we added in the multi-user version of virtual reality, so using multi-user, people can be dispersed around the globe, use a cloud-based solution and join in that session each with their own hardware, each with their own headsets, see each other, be doing work together, being able to measure things, move things, try things out, walk around their design in full-scale, and that's when people started coming back and saying, "Right, now I can do something different in my processes. I can bring people together."

PAUL: And that's because that we're leveraging the power of the cloud to bring together collaboration. I think there are other areas that we're seeing. We're seeing an increasing use of tools like generative engineering, where designers are leveraging the power of simulation and bringing simulation closer into the design process, into the creation process. So leveraging technologies like optimization, and particularly when you start getting into multi-disciplinary optimization, when you are not just looking at structural and stresses, but you're also combining structural and stresses with something like flow and computational fluid dynamics and you're trying to do these really complex type analyses, you need compute power.

PAUL: Now, your options are you have local machines with loads of power or you leverage the cloud, you leverage the compute power in the cloud. As you mentioned, that gives you that kind of near infinite compute power to help you do that and bring that simulation in to help you in that area. So it's giving you that more flexible infrastructure to be able to deliver the power when you need it to the people that need it. And I think those are the types of things that people are looking to actually say, "Okay, well, this is going to make a big difference in my product development process."